Inflation Watch – Is goods-flation a bigger issue for the BoE and the ECB than the Fed?

With the release of freight rate data earlier today, there are still good reasons to believe that goods inflation will arrive throughout the summer across USD, EUR and GBP inflation. While the exact impact and lags of rising containerized freight prices are yet to be discovered, it’s possible to study which markets will be hit hardest should goods inflation rise through a simple “what-if” study.

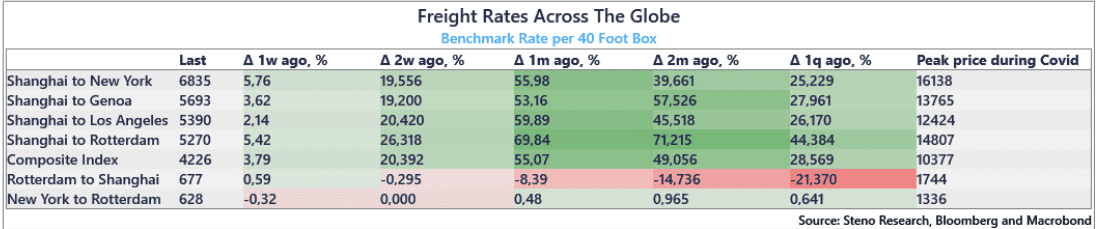

The increase in freight rates seem to have cooled a bit compared to April / early May, but we are still placed around 3-5% in weekly increases across the key routes globally, and the current “no news from Gaza” scenario leaves few arguments as to why the increase should suddenly stop over the coming months, especially given the futures curve hinting at substantially higher freight rates.

Chart 1: Freight rates are still rising

There are reasons to believe that goods inflation is on its way back with ETA during the summer, but while freight rates are on the move globally, the effects on price pressures should be more of a concern to the ECB and BoE compared to the Fed.

0 Comments