G5 Rates Watch: Mirror mirror on the wall, who’s the biggest interest rate cutter of them all?

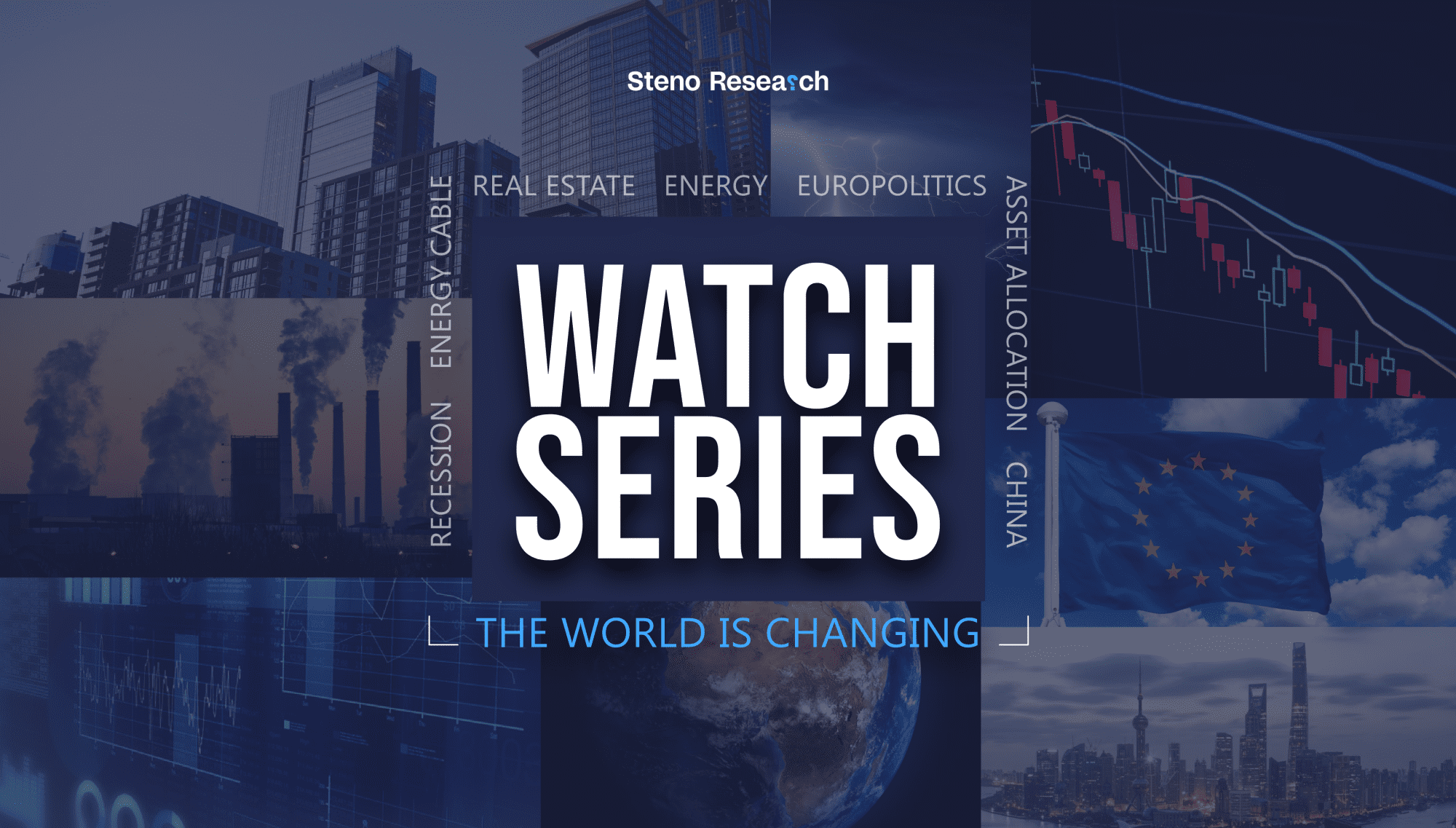

The central bank outlook looks surprisingly uniform as the market has homed in on June as the first timing for the cutting cycle from most major central banks (except the BoJ).

Markets feel certain that the SNB and the ECB cuts in June (we agree), but Fed, RBA, BOC and BoE pricing is closing on 50/50 calls after a series of sticky inflation numbers from North America.

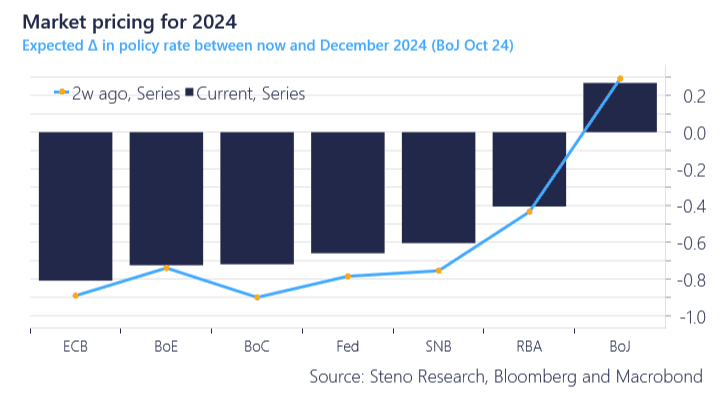

The Fed is priced hawkishly relative to the 75bps dot plot for 2024, while the ECB is the most dovish central bank in forward pricing for 2024 but yet falls short of the 100bps hinted by the Greek member Stournaras last week. The market sees a couple of 10bps hike from the BoJ this year.

So is this pricing fair? And what are the major drivers of the decisions from each of these central banks? In this short and sweet research piece, we look at the major central banks one at a time ahead of a crucial week.

Chart 1.a: June meetings pricing in forward rates

Chart 1.b: 2024 pricing in forward rates

We sum up a yuge week ahead in this brief and chart-heavy update on the big central banks. Where’s the value to be found in rates space this week?

0 Comments