FX Watch: The Scandinavian FX massacre

Being a Danish citizen, I have been asked over and over in recent weeks about the weakness in Scandi FX with NOK and SEK hovering at the weakest ever levels versus the EUR. Interestingly, some of the consumer patterns of 2010-2020 have reversed, which suddenly makes Denmark stand out as the positive consumption story in Scandinavia (in contrast to 2010-2020), while both Norwegian and Swedish consumers have been brought to their knees.

Last weekend Christer Gardell of Cevian accused the Danish Kroner of being a slam dunk short-selling case and he added that there was no reason for the DKK to be that strong compared to NOK and SEK. This made us want to dive a bit into the three currencies to find out where they actually stand.

Key take aways:

- Danish Consumers stronger than its neighbors due mortgage structures and lower inflation rates

- Norges Bank selling too many NOK’s in the market compared to its income from dividends and oil & gas

- Sweden’s high beta industry suffering under inflation and rates shock

- SEK looks like an interesting long ahead of the Riksbank, while NOK could return to it’s weakening trend unless the budget assumptions become more reasonable

On the NOK and SEK in light of central banks

Norges Bank delivered a 50bp hike earlier today due to a weaker than projected NOK paired with upside surprises to NOK inflation. Norges Bank very mechanically takes these things into account in their rate path model, which means that today’s material strengthening of the NOK would take the rate path lower again should they update projections.

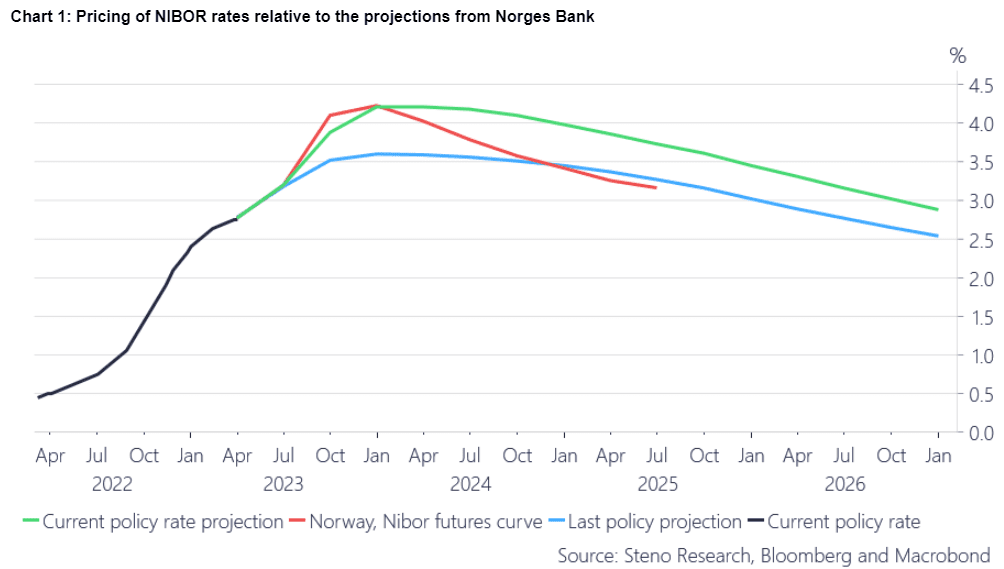

Norges Bank revised its rate path >60 bps higher for Q4, hinting at a peak in the policy rate at 4.25% (50 bps above levels seen today) or a peak around 4.67% in NIBOR 3m terms, which remains below current market pricing. This is the first major attempt to stabilize the NOK, but we consider the rates policy less relevant as a driver compared to Oil and the liquidity effects of the FX purchase/selling policy. More on that in a second.

Chart 1: Pricing of NIBOR rates relative to the projections from Norges Bank

Norges Bank finally made a decent attempt at underpinning the NOK, but the issue is that rates don’t really matter for the NOK. They matter a bit more for the SEK, which makes a SEK long tempting ahead of next week. Is the Scandi bloodbath over?

0 Comments