FX Watch – Exploring FX fundamentals

With central bank policy and energy having dominated FX throughout 22’, we have a look at what underlying fundamentals and correlations are telling us about the fair value of the hottest FX pairs currently.

Hello everyone, and welcome to a shorter piece on where to find fundamental value in the current FX environment. We’ll take a trip back to the theory books and use some of the good old correlations and fundamental value metrics to give some insights on the best FX bets now that the tightening cycle is likely soon coming to an end.

Read along, as we run through the most important pairs below.

JPY

- BoJ announced an adjustment of the YCC today, allowing JGB 10-year yields to rise above 1% (there is de facto not a cap anymore), and while it sounds JPY positive at first glance, the QE required from BoJ to allow a smooth transmission of monetary policy (prevent yields from exploding) will likely send USDJPY well above 150 for now.

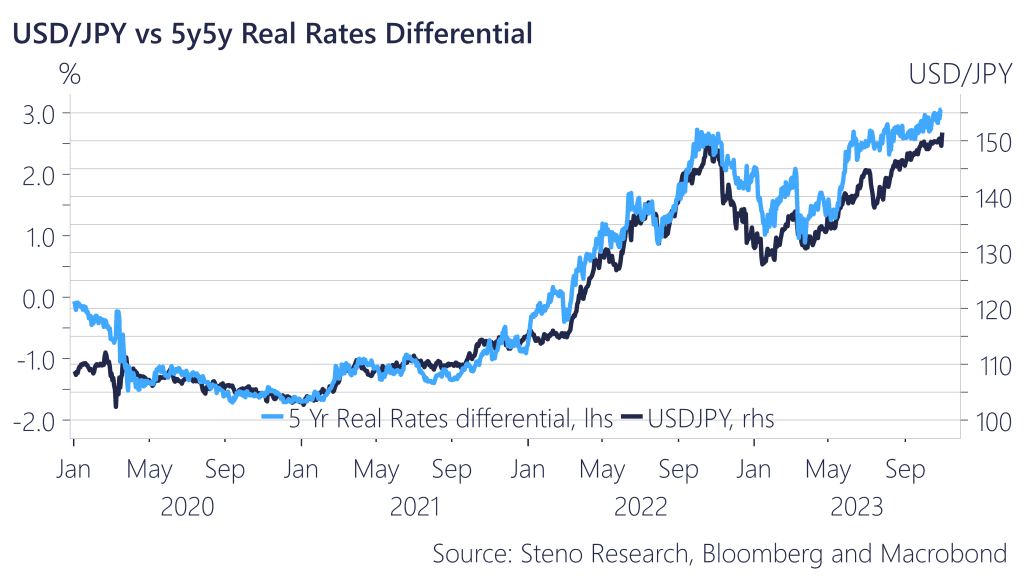

- USDJPY is currently very driven by real rates, and as US real rates continue to outpace JPY peers, we see 155 as the fair value.

- LNG imports in Japan are on the rise again, and that’s typically net negative for JPY. An interesting gap is emerging between JPY pairs and LNG imports, which speaks in favor of further JPY weakening.

- The real exchange rate (PPP) is starting to look gloomy for Japanese households, as a weaker currency paired with lower relative inflation is hollowing out the purchasing power. Will more inflation be imported as a consequence? Even higher inflation might be the only way to save the Yen.

Chart 1: 155 levels in USDJPY incoming?

With central bank policy and energy having dominated FX throughout 22’, we have a look at what underlying fundamentals and correlations are telling us about the fair value of the hottest FX pairs currently.

0 Comments