EUR Watch: Damned if you do until you are damned if you don’t

Conclusions upfront

1) EUR assets will suffer if the activity levels rebound too quickly due to a lack of elasticity in the commodity/energy supply in Europe

2) EUR assets will suffer if financial conditions become tight enough to reveal the lack of true credit appetite in for example Italy

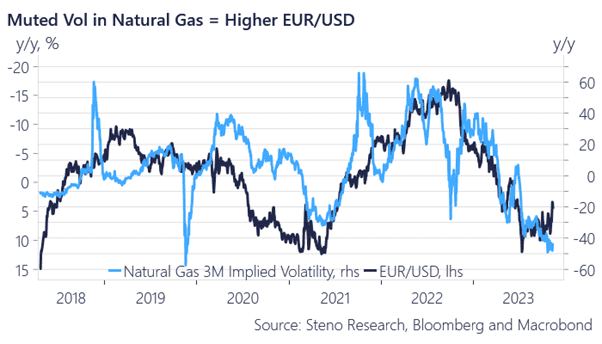

The EUR has recently regained its footing versus peers and we find the low volatility in Natural Gas to be the main explanation. The EUR (and EUR assets) have suffered from a damned if you do, damned if you don’t a scenario in recent years as the scarcity of energy has taken center stage in the pricing of everything from the EUR, to EUR discount rates and EUR risk assets.

Low volatility in energy prices allows energy-sensitive industrials to brighten up the outlook, which is initially good for the EUR, but the problem is just that there is a potential negative embedded feedback loop in that journey. If activity rises fast, energy prices will have to follow due to a continued weak supply side and the cyclical positivity may hence be killed before it even gets going.

Chart 1: EURUSD is inversely correlated to Natural Gas volatility

What is the path of least resistance for EUR assets here? The Eurozone keeps combatting scarce energy supplies paired with weak production.

0 Comments