EUR-flation Watch: Hands down, I was wrong..

We had hoped for a soft European inflation report in February, but we have to admit that we were off. End of discussion.

Rents, energy-tariffs / network-prices and a few wage heavy service categories continue to keep February inflation numbers elevated, albeit substantially lower than in 2023, and our nowcasts suffer a bit from changes in lead/lags on especially wage heavy categories.

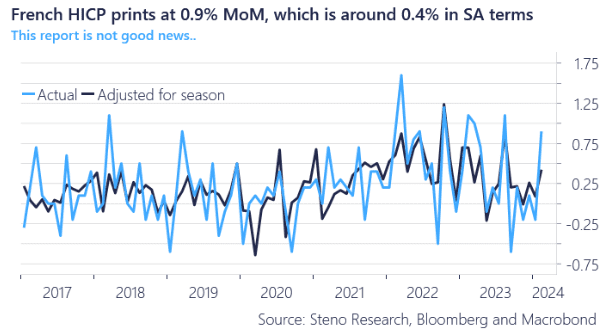

French HICP printed pretty much in line with consensus or even a tad above. 0.9% MoM in French HICP inflation equals 0.4% in SA terms. This is hot relative to trend admittedly and far from what we had anticipated.

We can deduct from the release of the YoY numbers that services increase YoY meaning that they beat the 0.84% MoM increase from February-2023. That is the main culprit in France relative to our projections.

Insee writes “Over one month, consumer prices rebounded in February 2024 (+0.8% after ‑0.2% in January). This rebound is due to the increase of prices of services, in particular rents and transports, and of those of energy, especially electricity, manufactured products and tobacco. On the contrary, prices of food decreased slightly over one month.”

Base-effects remain benign for the upcoming months and assuming a 0.4% trajectory, which is a hawkish path, we would be back close to 2.5% in March in French CPI numbers.

Chart 1: A hot French HICP number

Disinflation is simply not happening as fast as anticipated by our models, but base effects remain very benign in coming months. The stickiness in services is eye-catching, but there is light at the end of the tunnel for the ECB.

0 Comments