EUR-flation Watch: A major surprise is needed in February

The EUR HICP report for February needs to be very soft to tempt the ECB into spring action.

The über-hawk of the committee Holzmann said the following on Bloomberg earlier:

“But typically the Fed always in the last few years has always gone first by about half a year so I would assume, ceteris paribus, as things are, that we would also follow with delay,”

which rhymes with market fears that the ECB, despite the outlook warranting a softer stance than the Fed, remains caught between a rock and a hard place when discussing the timing of the first cut.

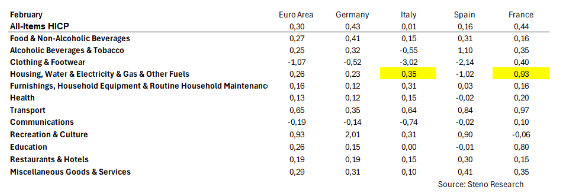

We see Euro area HICP coming in around 0.3% MoM and most importantly German HICP coming in around 0.43% MoM in our nowcasts, which is probably around 0.2%-points below early consensus. Whether that is sufficient to bring an April cut back in play is debatable, but it will obviously move the needle in that direction next week, if we are right.

The French HICP is impacted by the ‘Bouclier Tarifaire’ in February with a close to 10% tariff increase on electricity. The same cost category is also impacted by VAT increases in Italy, and we see the biggest risk of an underestimation of VAT impacts in Italy for February, while we are almost 100% certain on the impact in France.

Chart 1: HICP nowcasts

The ECB is scared of acting ahead of the Fed, why a substantial dovish surprise is needed in February HICP to bring about a decent probability of spring action from the ECB. Find our updated now-casts here.

0 Comments