Energy Watch: Time to buy oil again?

Conclusions up front:

– We agree with OPEC that the demand side seems to be doing decent

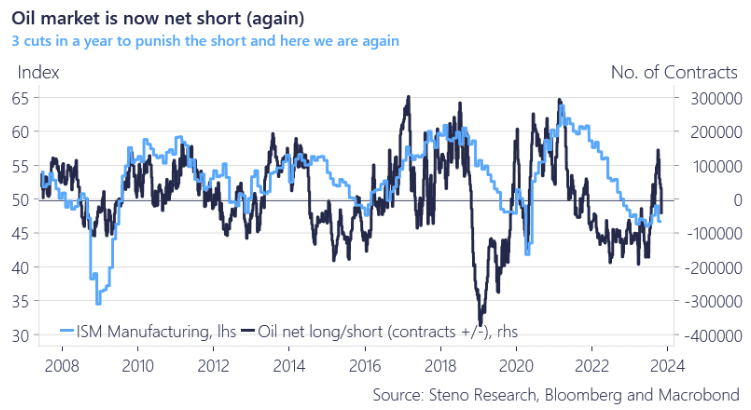

– Paper markets are net short oil again

– Our model is approaching the buy zone despite the recent weakness seen in Oil

– The big risk to our model is a supply increase from an exhausted Saudi Arabian one-man-army

The monthly OPEC report was released earlier today and the latest demand outlook from the monthly report suggests that we’ll have a slight uptick in 2023 demand and supply. Opec revised up its 2023 oil demand growth forecast by 20,000 b/d from last month to 2.46mn b/d. This was mainly driven by third and fourth quarter upgrades to China’s oil demand growth, which Opec now sees at 1.14mn b/d in 2023, up by 70,000 b/d.

OPEC chimes in and reports: “Global oil market fundamentals remain strong despite exaggerated negative sentiments”. Will OPEC’s upward demand revision be the first signal that more production is coming online? If so, OPEC used 3 cuts, blew a lot of dollars and got nothing to show for it. Anyway, this does not necessarily mean that Oil is a good short from here. Our models rather point in the opposite direction.

Over the last month short-sellers have loaded up despite OPEC insistence on tightening and undoubtedly to MBS’ anger. The original cuts back in the spring were intended to wipe out short sellers in the paper markets as OPEC deemed that physical demand was strong. Something that we have largely agreed with up until this point. What MBS perhaps didn’t expect, and what we have been flagging over the summer, is that individual members of OPEC are adding supply to fund their needs (wink, wink Russia).

OPEC increased the demand forecast and continues to highlight paper market shorts as the reason for the weakness in oil markets. We largely agree but also see signs of exhaustion coming out of Saudi Arabia.

0 Comments