Energy Watch: The perfect bull-signal delivered by Olaf Scholz?

We typically release our weekly EIA Watch on Thursdays but given this press release from the EIA, we will not be able to update the demand side data this week. “EIA will delay its scheduled data releases November 8-10, 2023, to complete a planned systems upgrade. We will continue collecting energy data from survey respondents and will resume our regular publishing schedule on November 13. See our latest press release for more details.”

Instead, we will have a look at some of the most important indicators in the Energy space as oil markets have left blood on the streets lately, leading Saudi Arabia to once again “call out” short sellers. Is there a fundamental downturn in demand or is this recent trend in oil once again driven by the positioning of paper markets?

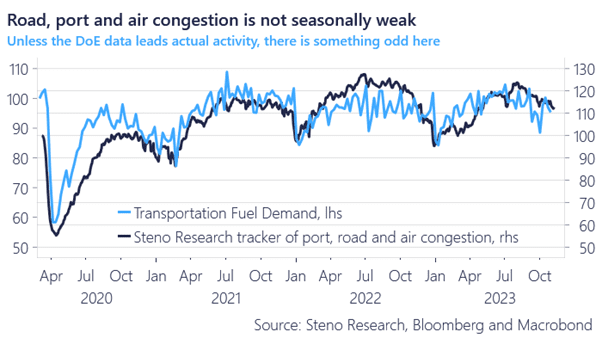

When we look at the congestion across roads, harbors and airports, we find nothing out of the ordinary in terms of demand for transportation fuels. The September/October weakness seen in e.g. the EIA demand data hence looks like a data glimpse rather than an actual reflection of underlying weakness in demand.

Chart 1: The demand is not seasonally weak for transportation fuels

As the EIA data is postponed until next week, we look at other factors of relevance for the supply/demand equation in the energy space. Nat Gas bulls have more reasons to be upbeat than Oil bulls, but is the demand so weak for oil?

0 Comments