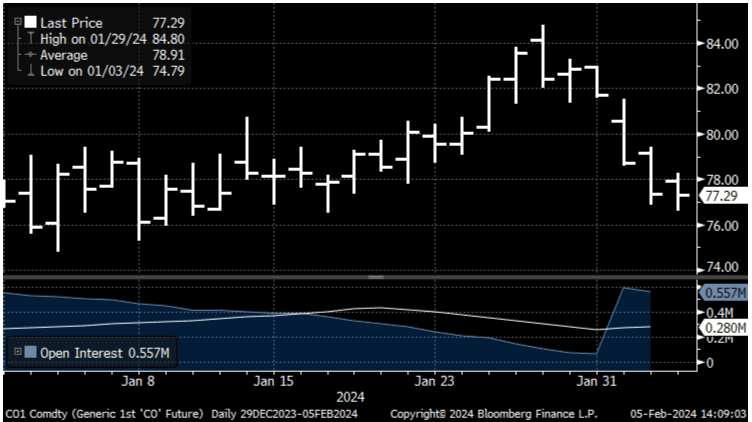

Energy Cable: Crude oil above 80.. it was fun while it lasted

It seems like all it took was one bulletin from Al-Jazeera about a potential ceasefire between Hamas and Israel for crude oil to lose all its gains from the prior week. And the fact that the bulletin was retracted 15 min later didn’t seem to bother crude oil markets one bit in their eagerness to hit the sell bottom.

We find it confusing that markets believe that a ceasefire between Israel and Hamas will all of the sudden bring calmness to commodity markets. The Houthis are only using the conflict in Israel (Which is 38 hours by car away from them by the way) as a bad excuse to promote their own cause and a ceasefire changes nothing for them. We believe that there is still some geopolitical risk premium that should be reflected in crude given shipping lane disruptions in both the Suez and Panama.

Chart 1.a: One week of crude oil above USD 80 was all we got

Chart 1.b: Heightened geopolitical risk

Crude oil above USD 80 lasted all but a week and we are now trading in the January range again. Here is our take along with some oil-related news from the week. The structural oil bet is still improving beneath the hood.

0 Comments