Energy Cable: Commodities, Freight Rates and Goods imports are rising and you tell us that demand is weak?

Main take aways:

- A soft CPI report was just what Commodities needed to take the next leg higher

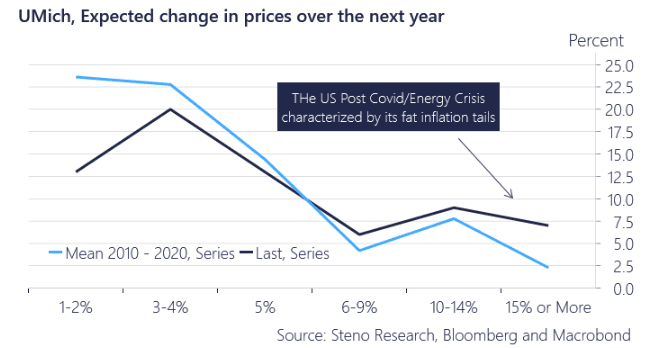

- Inflation expectations fat tailed

- Commodities on the move, but we still need oil

- China to export inflation to Europe?

Despite last week’s dovish inflation print, we are not sure that it is disinflation that we need to be worried about, both in the short- and long term. Let’s discuss three reasons for that.

First, as seen in the short term inflation expectations from the UMich survey (chart 1), right tail risks for inflation expectations have become fatter by some 5 percentage point while respondents expecting inflation to print within Fed’s preferred range have dropped by 12.5 percentage points on aggregate. Welcome to the post-Covid environment!

The divergence between median and mean inflation expectations in the survey is also interesting and while it is true that if Bill Gates and I walked into a bar, then on average a millionaire walked through the door, we would argue that fat tails are important in handling markets with this inflation story being no exception.

Chart 1: Post Covid driven by fat inflation tails

A soft inflation report was apparently exactly what the Commodity space needed to fuel another move higher. Softening (lagged) inflation numbers such as rents, will help solidify the re-inflation loop, which looks increasingly bullish to us.

0 Comments