Energy Cable #63: It is still all eyes on China

Take aways:

- Solid PMI numbers out of China supporting the reflation story

- Steel Production looks ok

- There is still potential for the USD to throw a wrench in the works

This week we’ll pick up where we left off last week and continue to talk about China as we have had a surprise in PMI numbers The composite index came in at 52.7 supporting the thesis that things indeed are improving in China which our congestion nowcasting is supporting as well.

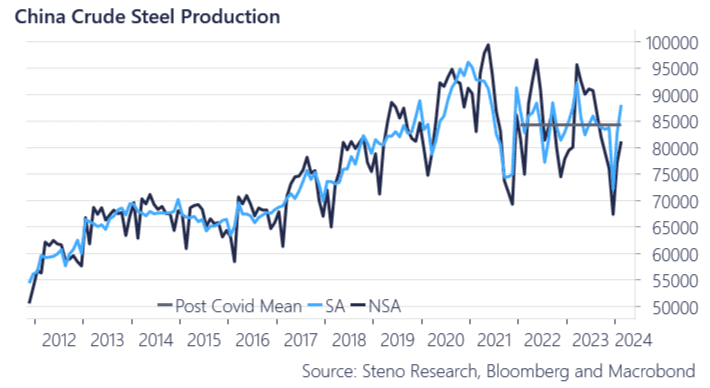

Apart from looking closely at copper where we flagged the boom in stock levels, another key commodity to gauge Chinese growth is steel. The latest production numbers are hovering around the post pandemic mean. They are not alarming nor are they something to cheer about. For fans of The Wire they are “a 40 degree days” so to say.

From chart 1.b we see that manufacturing and infrastructure have to pick up the slack from real estate and thus it is key that we keep seeing improvements in manufacturing PMI numbers from China for the reflation story to hold true. Also note how volatile the production output has been post Covid in China, even in SA terms. It is very difficult to say something with 100% conviction given this data.

Chart 1.a: No major alarm from steel production

Solid numbers out of China over Easter solidifies the commodity case including in Energy. If China is actually moving, commodities remain too cheap.

0 Comments