Energy Cable #61: Commodities are breaking out #2!

Last week we wrote about the price action in commodities and the week ended in some strong gains across the space. Our portfolio remains tilted strongly towards cyclical / inflationary bets such as materials and crude. For the whole portfolio click here: Steno Research Portfolio.

Chart 1: A snapshot of our portfolio

We have a big week ahead of us in terms of potential macro movers in commodity space. Firstly we have four major central banks talking with all ears on their inflation/rates outlook. That will especially be the case for the Fed and BoJ since the USD implications are the greatest.

We are keen to see what the Fed thinks of short term inflation expectations rising 60 bps YTD and if it has any implications on their overall outlook as markets price in almost three cuts for this year. For the BoJ, lifting rates could make Japanese investors seek home and sell their UST positions, giving the USD a push higher, especially if they surprise markets with balance sheet twists on top of a rate hike.

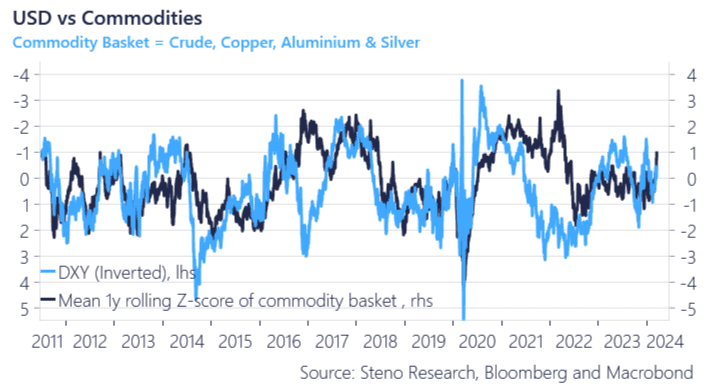

From the below chart we see the close correlation between a commodity basket and the DXY and note the strong momentum of the basket last week approaching +1 standard deviation on a 12 month rolling z-score while the USD stood still. Going forward the global inflation/reflation wave will have a lot to do with what central banks, especially the Fed, do.

We see the Fed tilting towards a tapering of QT, which is a reflationary policy by design allowing for a net commodity positive take-away. The decision will likely be taken already on Wednesday.

Chart 2.a: USDs tight inverse correlation with commodities

Commodities have broken out of recent price ranges left, right and center over the past 1-2 weeks and we have timed the entries well. Read along to find our top-picks in Commodity space right now.

0 Comments