Energy Cable #58: MASSIVE bottlenecks and abundances in shipping and energy space

Hello from a sunny but chilly Copenhagen.

Since we haven’t talked about shipping in a couple of weeks, we thought that we would do an update on what currently looks like an overextended market searching for a new equilibrium. The shipping rates may have plateaued at elevated levels, but now is the time where spill-overs are starting to show up in physical goods and commodities.

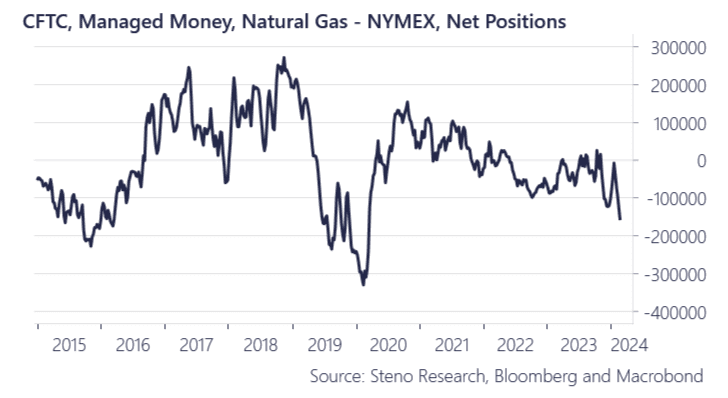

We entered a highly contrarian long position in Nat Gas last week among other things due to technicals and a stretched positioning, but also due to the spill-overs from shipping. Last week, net positioning reached lows not seen since peak lockdowns leading prices below sector break-evens. This is likely going to lead to an OPEC versus paper market style game of chicken between producers and CTAs, with a large correction possible if short-sellers blink first

We expected a bumpy ride, when we entered and the volatility has not failed to deliver, but we are so far in the money on the trade. The massive freeze in global shipping is worth tracking here as the current supply side abundances is likely a symptom of future demand side scarcities.

Read long why below..

Chart 1: Ultra short positioning i natural gas

Nat Gas levels are far below sector break-evens, making it a tug of war between short-sellers (mainly CTAs) and producers. Nat Gas looks like a bargain, but let’s see whether the chicken comes home to roost.

0 Comments