EIA and OPEC Watch: Depending on Nigeria and Iran

Welcome to our weekly EIA watch paired with a few remarks on the postponed OPEC meeting.

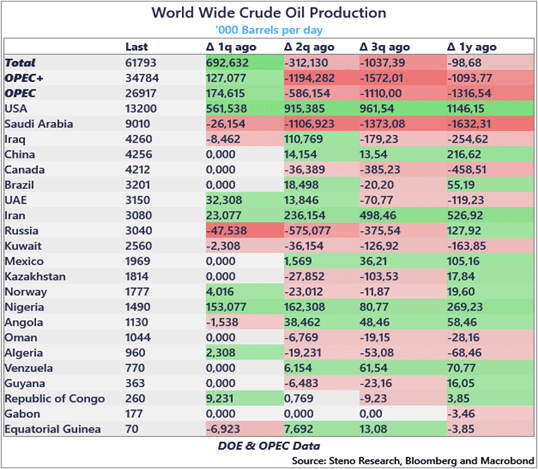

We have had a look at OPEC production and export numbers, and it seems like production is much more price bullish than actual net exports (meaning a draw on local OPEC inventories)

Interestingly, the US, Nigeria, Iran, UEA (among others) have managed to fill a lot of the production gap left open by left open by Saudi Arabia.

Overall production is up 0.7mn a day since a quarter ago. Not what the Saudis wanted overall. It seems like they have been caught by surprise by the strength of the US supply (We have admittedly been surprised as well). Nigeria is probably the troubling country in question (alongside the running battle with Iran) when Saudi Arabia and Russia postpones the meeting.

Iran is impossible to deal with, but if the Saudi Arabians can offer Nigeria a decent package, we suspect that a very decent supply cut deal will be orchestrated next week.

Find the full assesment of the EIA data below. Large and tradeable discrepancies are found!

Chart 1: OPEC and non-OPEC production

The OPEC meeting was postponed, likely as Saudi Arabia is dissatisfied with being a one -man-army in the oil supply battle. Meanwhile, EIA data (mostly) continues to support our bullish year-end thesis.

0 Comments