Debt Watch: Will the US Treasury spook markets with issuance in the QRA again?

Good evening from Europe!

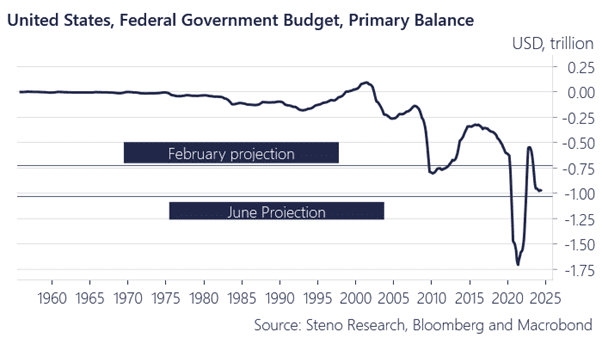

The quarterly refunding announcement is due on July 29, and it always holds the potential to spook duration markets and liquidity betas. The release of the updated budget projections from the CBO in June garnered attention as they raised their budget deficit projections by around $400 billion compared to the winter projections in February.

Not all of these outlays are newsworthy for the US Treasury. For example, the student loan forgiveness worth more than $150 billion was approved in late February and hence considered in the April announcement from the US Treasury for the second quarter. In contrast, the Ukraine aid package of around $95 billion was approved only minutes before the updated numbers for Q2 were released and will accordingly impact the Q3 QRA.

The trajectory of the primary deficit is slightly better than feared in the June CBO projections for 2024, as tax receipts improved year-over-year through June and July, contrary to expectations. If we are correct that the economy is not slowing, then a few rate cuts paired with decent growth trends may lead the primary deficit to be a little less than feared by year-end.

Nonetheless, we are still talking about increased issuance relative to the April assumptions, potentially by as much as $150-175 billion in Q3.

Chart 1a: Primary balance versus CBO projections from February and June*

The CBO has markedly worsened the deficit outlook since the last issuance update from the US Treasury in April. Expect the Treasury to communicate a sizable increase in the issuance target, but also expect them not to follow through on it. Let’s look at why.

0 Comments