China Week: This is China’s successor in global manufacturing

SUMMARY:

- China’s spectacular growth window is closing and their demographics aren’t looking good

- The prime candidates for becoming “the Next China” are to be found in Africa

- Looking at a number of quantifiable variables such as dependency rate, education, infrastructure and much more, we narrow down the contenders to a couple of really intriguing African countries.

The spectacular 40-year growth window of China is closing – and the search for the next big development fairytale has already begun. Many observers have argued that Africa, the continent with the fastest growing working population, is poised to fill China’s shoes in global manufacturing. The sentiment is shared with leaders across the African continent including Rwandan President Paul Kagame who has promised to transform the nation’s economy into the “Singapore of Central Africa ” (Aidoo, 2012). While an Ethiopian technocrat is known to have said that “We are 20 years behind China” (Fourie, 2011).

‘Africa is the next China’ is a statement that is thrown around because everyone wants to see it happen: the least developed countries experiencing exponential economic growth without relying on aid – it’s a win-win for Africa and the world. However, one cannot help but notice a gaping deficit in nuances in the statement. First of all, Africa is not a single country like China – it’s a continent of 54 VASTLY different countries.

Is the whole of Africa equipped to take over as the world’s manufacturing hub, or which one of these countries will take over from China? Will this transition happen tomorrow, in 10 years or in a century?

These are the crucial questions which are oftentimes left unanswered. USING DATA, we will attempt to rectify this oversight in this edition of the Demographics Watch series (China Week Special!).

Step 1: The Demographic Dividend

The demographic dividend is defined as the potential economic benefit offered by changes in the age structure of the population.

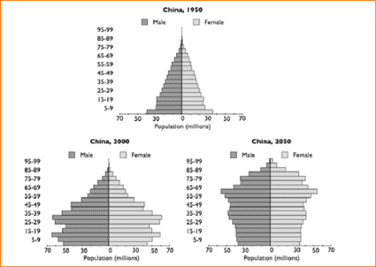

During China’s demographic transition, the country went from a period of skyrocketing population growth followed by drastic drop in fertility rates (accelerated by the politically-mandated ‘one child policy’). The sudden drop in child births in an otherwise relatively young population meant that China’s working population outnumbered dependent children and elderly people by almost 3 to 1 at its peak.

China Demographic Pyramids in 1950, 2000 and 2050 (Forecast)

In 2000, China had a surplus of people in the working age (16-65).

The period of low age dependency has benefitted Chinese growth for almost 40 years now. During this time, the Chinese government has been able to invest its surplus revenue on roads, education and public health instead of child support and pensioners. Japan, South Korea, Hong kong and Singapore went through a similar demographic transition between the 60’s and 90’s.

One survey estimates that, on average, a surge of 1 percentage point increase in the working-age population boosts GDP per capita by 1.1 to 2.0 percentage points, and savings by 0.6 percentage points (World Bank, 2016a:275). The vast majority of African countries have a young population – but so far, fertility has remained high meaning that many young children are outside the working age.

Which African country boasts the lowest forecasted dependency rates?

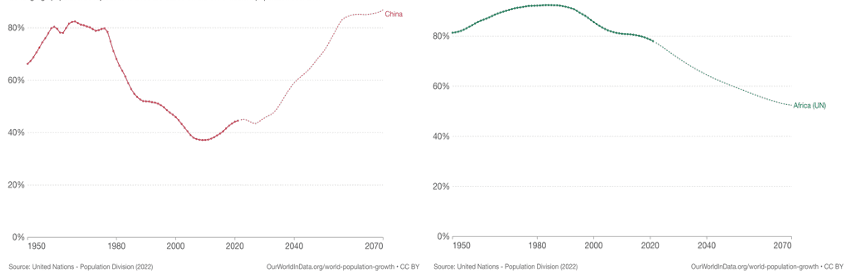

Age Dependency Ratio Projections, China and Africa, 1950 to 2070 (projections)

The age dependency rate describes the number of children below 16 years of age and elderly people above 65 compared to the working age population (16-65 year-olds). So, for example, an age dependency level of 86.11 % in Nigeria means that there are on average 86.11 dependents per 100 working people. The lower dependency level, the better.

The first thing worth noticing is that Africa’s demographic transition is going slower than one might expect reading the ‘glowy’ editorials on growth potential in the region. Matching up the (projected) timelines of Africa and China’s demographic transition, it is clear that the expected drop in fertility rates in Africa isn’t nearly as dramatic as China’s in the 80’s and 90’s.

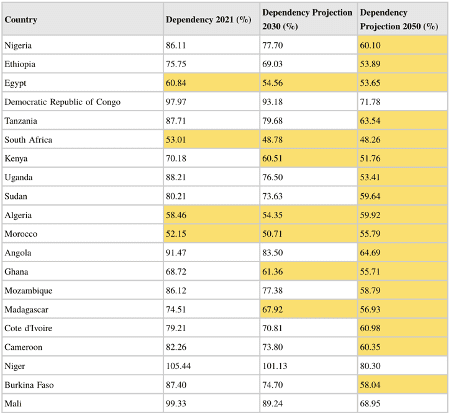

The table below tells the same story: among the top 20 most populous countries in Africa (2021 levels), only 4 currently have dependency levels that match China in 1980 (when the country first experienced yearly double-digit GDP growth). We need to get to 2050 before most countries have caught up with China anno 1980 – but even at this point, no African country can match the 39% dependency level that China mastered in 2005 when they hit peak growth.

Age Dependency Ratios (%) for Top 20 Most Populous Countries in Africa, 202, 2030 (Forecast) and 2050 (Forecast)

Quick note: There is no doubt that the size of China’s working population in actual terms has been a crucial factor in the country becoming an economic powerhouse. So, for the sake of simplicity, the table above and the following analysis will focus on the top 20 most populous countries in Africa. These are all countries that currently have more than 20 million inhabitants.

Setting aside countries in Northern Africa + South Africa which are further along on their development trajectory, Ethiopia, Kenya, Uganda and Ghana has the lowest (and therefore best) age dependency ratios.

Step 2: Education, Women and Health

It is worth emphasizing: economic gains from the demographic is NOT a certainty. An important conditionality is the government’s ability to rethink its social policies in new demographic conditions, especially regarding women in the workforce.

In the first edition of our Demographics Watch series, we took inventory of the global problem of aging populations. The issue is a familiar one in the West, but ‘The Asian Tigers’ too are waking up to a new reality of shrinking working populations. Who is next in line to take over from China as the world’s labour hub?

0 Comments