The Week At A Glance: It’s getting hot in here! CPI week..

Welcome to the weekly “The week at a glance” publication where we look at the key figures during the week ahead and how to trade them.

We have already been banging the drum on the upside risks to the US CPI, but the risk picture is also tilted in a hawkish direction for GBP and SEK rates over the next week. Meanwhile, we expect China to surprise negatively, which once again puts the spotlight on the USD/CNY fixing.

Let’s have a look at the details.

Tuesday – UK wages, US PPI and US NFIB

UK labour market report

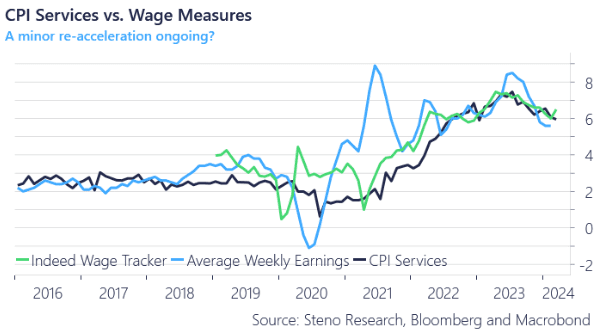

The UK labour market report will impact the understanding of the path ahead for the Services inflation and we see clear upside risks to the consensus of a 5.5% YoY print in the average weekly earnings. The indeed wage tracker has re-accelerated lately and suggests that wage growth remains above 6%, while our nowcasts also suggest that April hiring was much better than March.

Chart 1: Indeed wage tracker points to a re-acceleration in the UK

Full focus on the US CPI report and the consensus is heating up! Meanwhile, the UK labour market will be important ahead of a clutch UK CPI report the week after.

0 Comments