Steno Signals #52 – Remember 2007? It’s here again… 5 reasons why we will repeat all mistakes

Happy Sunday and welcome to our flagship editorial. As per usual, expect loads of charts with a few paragraphs to support them. If you cannot show it in a chart, then it’s not true 😊

We are back discussing a soft landing in most of our client interactions and consensus economists currently flock around a non-recessionary narrative for H2-2023. The vibes are getting increasingly reminiscent of Q1-Q3 2007, where the crisis was called off by almost all economists and markets rallied after a Fed pause.

This may be an obvious occasion to remind you of the two rules of economists:

1) For every economist, you’ll find another economist with the opposite opinion

2) They are both wrong

BofA’s most recent monthly fund manager survey now reveals an overwhelming consensus expecting a soft landing, but we are yet to see that optimism spilling over to positioning in equities. If the Fed pauses/skips on Wednesday (still our base case), then expect the positioning to move FAST in an optimistic direction (for US equities).

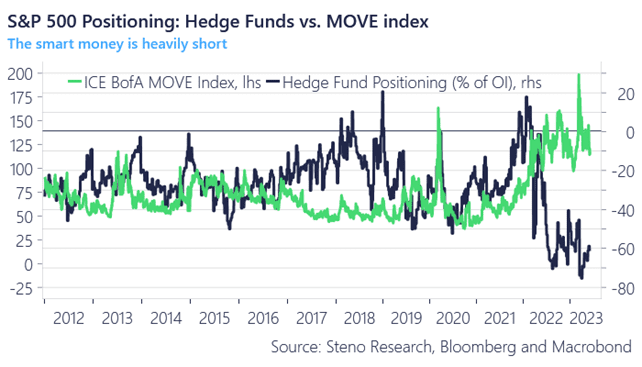

Rates volatility is the #1 explanatory variable for equity positioning and as a pause/skip clearly puts a dampener on rates volatility, we should also expect a rapid bullish re-positioning in the fast/smart money sector.

Find out how we think markets will be impacted with a 14-day FREE trial below.

Chart 1: Rates vol down -> equity positioning up!

Should the Fed skip/pause on Wednesday, we’d argue that market positioning will quickly unwind and turn optimistic. The soft-landing narrative is back on the agenda and all the mistakes of the past are likely to be repeated.

0 Comments