Steno Signals #114 – A Powell Put is Ueda’s Catastrophe

Happy Sunday from Denmark!

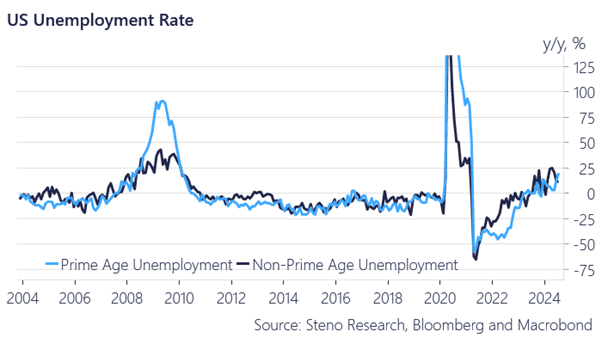

I’ve had a few days to digest Powell’s speech from Friday, and my takeaway is unequivocally dovish. Powell and the committee have signaled that they will not tolerate further cooling of the U.S. labor market without responding. This marks a full-blown shift in priorities, with inflation numbers now taking a backseat to labor market data going forward.

With the FOMC’s base case for unemployment remaining very mild at 4.0% for 2024 and 4.1% for 2025 (until updated in September), the Fed has effectively designed a policy reaction function that could allow them to cut rates aggressively. Whether there’s a major need for such an aggressive response is another discussion, but our focus is on making money from the next steps. A second inflation wave may ultimately arrive, but we will focus on that in due course.

The big question is how markets will respond to this cycle, and whether the USDJPY trade has further downside potential. Could Powell’s put turn into Ueda’s catastrophe?

Chart 1: Rising prime age unemployment is a concern for the Fed

The very late-cyclical pattern of a hawkish BoJ paired with a dovish Fed is now visible to everyone. How far will it take USDJPY lower, and will it pull the rug from under cross-asset markets?

0 Comments