Steno Signals #107 – The 3 indicators you NEED to watch on recession risks

Happy Sunday and welcome to our flagship editorial!

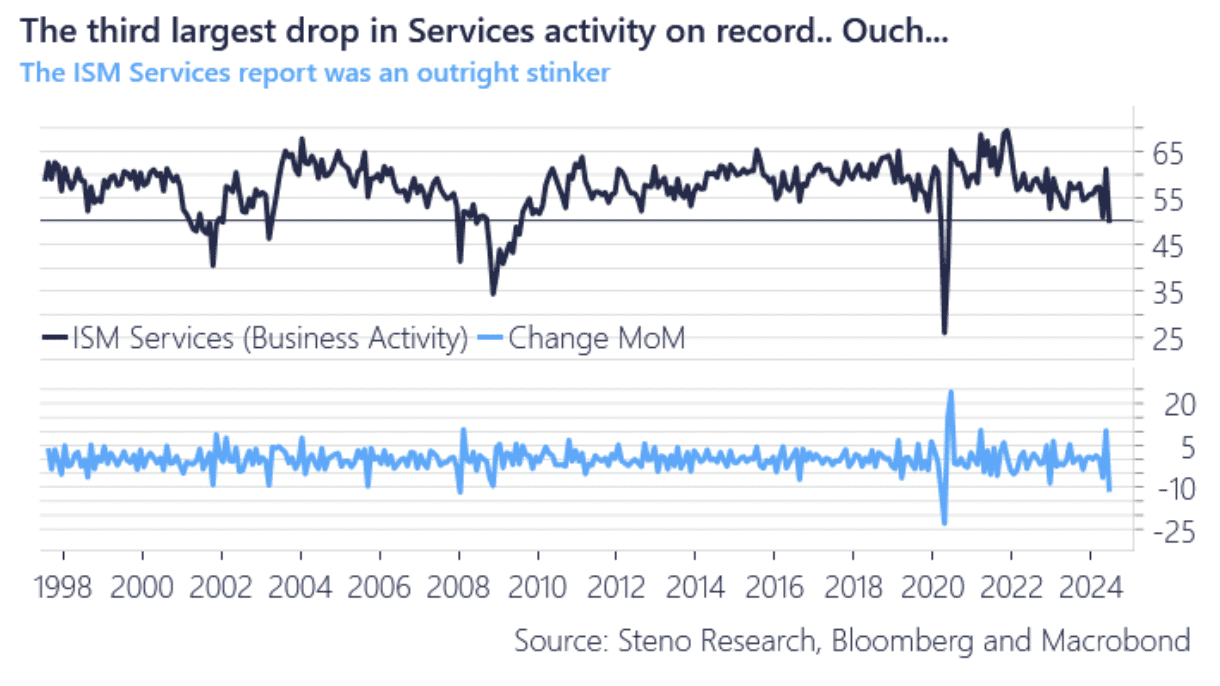

The ISM Services report admittedly made for recessionary reading, and it is not because we have been blind to such risks. We just found the risk/reward in betting on them incredibly weak, and we continue to hold that view.

We actually laid out exactly that roadmap to a recession in Q4 2023, and correctly forecasted that the re-acceleration in cyclical sectors such as Manufacturing would lead everyone to conclude that recession risks were off the table in 2024, with a major bull run in assets accordingly.

Here we are in early Q3 2024 with survey-based evidence of a light recession in Services, but there are so many out-of-the-ordinary developments in this cycle that it makes this much less straightforward than just looking at ISM Services and concluding that the wheels are about to come off.

Here is how we will assess the true recession risks for markets in the coming months and why we remain upbeat on markets despite this horrible ISM Services report.

Chart 1a: ISM Services weakened fast in Q2

The recession chatter is back in the US, and for good reasons. The big question is whether it will matter at all for markets. Here’s a list of indicators you need to watch to assess when or if to turn bearish.

0 Comments