Out of the Box: Don’t worry about the real rates spread, ECB

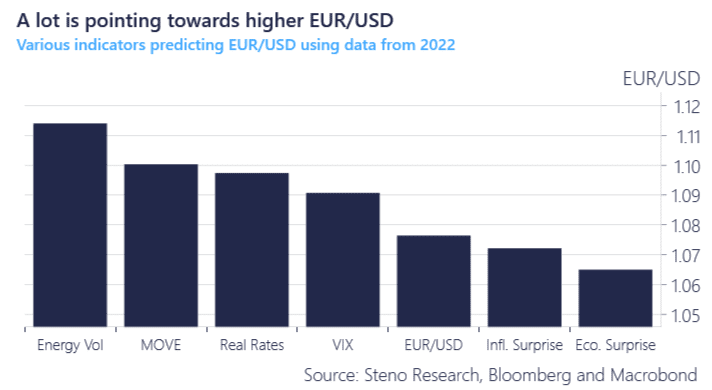

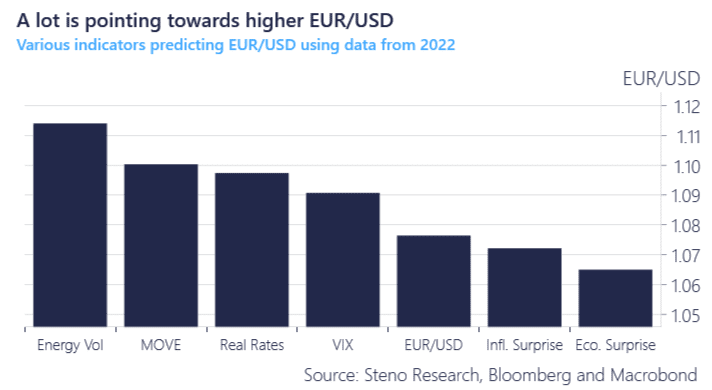

Even though manufacturing data and headline HICP year on year in the Euro Area are screaming for easier financial conditions, the ECB seems reluctant (or at least slow) to cut rates and rather prefer just to be the lagged Fed. If it is fear of wider real rates spread towards other currencies, especially the USD, then we argue that Lagarde & co don’t need to worry. Firstly, because we find arguments from the past 10 years that EUR/USD can go higher even in an environment in which USD – EUR real rates spread widen and that real rates is not the only macro factor in determining the EUR/USD path. Often real rates do not matter at all.

If the ECB was worried about Euro weakness then asking for the natural gas fields in the Netherlands to be reopened instead of trying to defend the currency with rate hikes would be the far better options. We see from chart 1.b how energy vol and its muteness over the last years is predicting EUR/USD > 1.11.

Chart 1.a: There is more to this than real rates

Even though manufacturing data and headline HICP year on year in the Euro Area are screaming for easier financial conditions, the ECB seems reluctant (or at least slow) to cut rates and rather prefer just to be the lagged Fed. If it is fear of wider real rates spread towards other currencies, especially the USD, then we argue that Lagarde & co don’t need to worry. Firstly, because we find arguments from the past 10 years that EUR/USD can go higher even in an environment in which USD – EUR real rates spread widen and that real rates is not the only macro factor in determining the EUR/USD path. Often real rates do not matter at all.

If the ECB was worried about Euro weakness then asking for the natural gas fields in the Netherlands to be reopened instead of trying to defend the currency with rate hikes would be the far better options. We see from chart 1.b how energy vol and its muteness over the last years is predicting EUR/USD > 1.11.

Chart 1.a: There is more to this than real rates

Chart 1.b: … And on a 1 year rolling regression 1 year real rates pointing to EUR/USD > 1.09

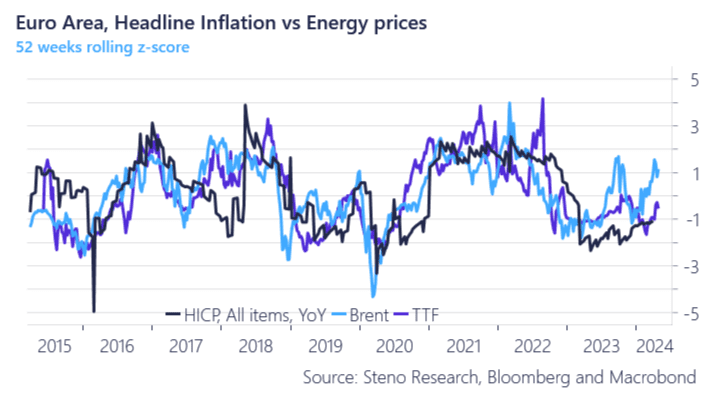

We find two things to be just as, if not more, important than monetary policy in terms of Euro strength. Firstly, commodity prices, especially energy, play a key factor for the Euro and price pressures in the Eurozone due to our energy dependencies here in Europe. Secondly, when input prices are cheap the manufacturing sector in some of Europe’s power houses benefit which in turns means that Euros are circulating around in the global trade system.

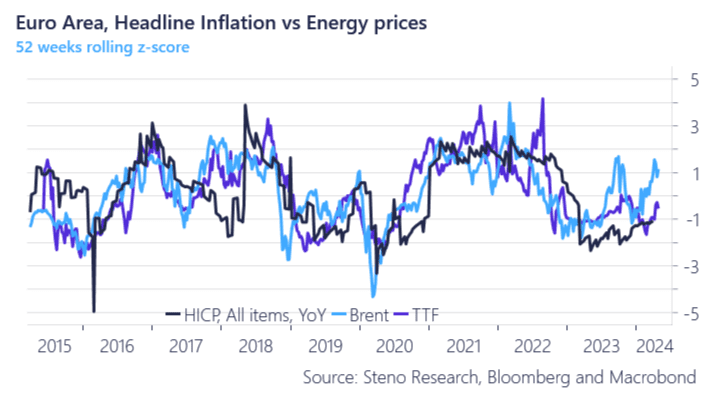

Just look at the correlation between trade balance and headline inflation for the Euro Area where the dangers of our energy independence become apparent, which is why European politicians’ insistence on closing nuclear power plants in Germany or gas fields in the Netherlands is perplexing. Moreover the sensitivity to energy prices might lead policy makers to treat supply side issues as demand side issues and you can ask Jean-Claude Trichet what happened last time he did that.

Chart 2.a: Headline HICP loving cheap input prices and goods export

Chart 2.b: Headline goes where gas and oil go

The bottom-line. The ECB can CUT without fearing a land-slide in EURUSD as long as energy prices remain contained in the Euro zone. Watch Natural Gas instead of the ECB for clues on the direction of the EUR from here. Rate cuts are coming in the Euro zone and the latest update of the indeed wage lab tracker, which is monitored closely by the ECB now, confirms the dovish path ahead. Even if the Fed (and maybe even the BoE) refrains from cutting.

Chart 3: Wage growth has vanished into thin air in Europe

0 Comments