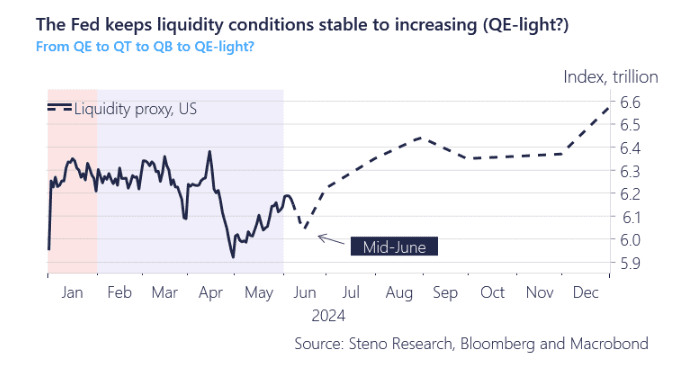

Macro Nugget: More liquidity and less pressure on the long end in June/July

The Treasury has reduced the sizes of short-dated bill auctions in early to mid-June, enhancing liquidity conditions. They plan to restore these auction sizes to February and March levels by July. This expected increase in bills auctions should add over $200 billion in debt in Q3, improving the liquidity environment as the fixed income markets won’t need to absorb longer coupons, preventing a rise in term premiums.

The Treasury General Account (TGA) is currently below its $850 billion target at $710 billion. A shift in liquidity from the Overnight Reverse Repurchase Agreement (ON RRP) to the TGA in July and August would be beneficial, particularly since the TGA must decrease significantly by year-end due to the impending debt ceiling deadline.

Despite Secretary Yellen’s preferences, the TGA cannot maintain its current levels as the debt ceiling deadline approaches. The suspension was enacted with a TGA mandate of around $60 billion, setting this as the necessary target before the January 1, 2025, debt ceiling deadline.

Overall, the outlook for liquidity developments remains positive.

For more please see our full take on this months macro regime and how to allocate accordingly

0 Comments