Great Game: Is a Hung Parliament bad news for markets?

In the blistering heat of summer, Spanish voters went to the polls on Sunday. It was expected to be a tough race for incumbent centre-left Prime Minister Pedro Sánchez, but the result wasn’t as clear-cut as many expected. Many analysts have pointed to a potential lengthy government formation process and painted this as really bad news for the Spanish economy – but is that really the case? Let’s start by dissecting the Spanish election and then looking into what this could mean for Spanish equities and coming European elections.

Remember to read my colleague Emil’s brilliant piece on the Spanish election here: https://stenoresearch.com/watch-series/spain-election-watch-why-spain-is-not-the-next-italy/

A divided Spain

The Spanish voters left the parliament ‘hung’ with neither bloc looking likely to form a majority without the support of the fringe local parties. The center-right bloc of PP and Vox looks most likely to form a government, but it’s very much up in the air.

Both the right and the left side celebrated the election results. The PP leader Alberto Núñez Feijóo claimed victory and declared his intention to form a new government while the left wing supporters celebrated the poor showing of far-right Vox party by chanting “No Pasarán” – the old anti-fascist slogan from the Civil War. In their minds, the election was no less than the turning point in their war against modern fascism.

Social democratic leader and incumbent Prime Minister Pedro Sánchez could still remain in office, but he needs the support of especially the Catalan separatists of Junts party led by the infamous Carles Puidgemont who lead Catalonia’s failed separation attempt several years ago.

There is no doubt that we’re looking into interesting and very decisive government formation negotiations over the coming weeks and months. The question is – will this state of ‘hung parliament’ hurt the Spanish economy and Spanish equities?

The psychology of a hung parliament

The mainstream hypothesis seems to be that political instability and uncertainty is bad news for the economy. Investors could be hesitant to make significant investment decisions and public spending and investment is often stalled or at least not expanded during a period of hung parliament with no government in place. But let’s have a look at some recent examples:

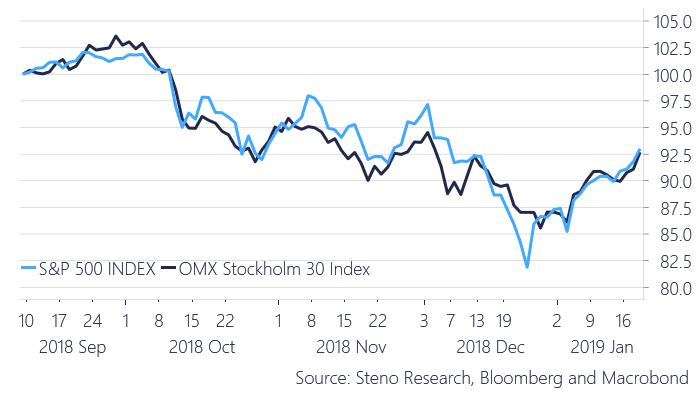

Our first case is the Swedish government negotiations of 2018-19. They were extraordinarily long for Swedish standards, but the OMX 30 index wasn’t really affected. This is remarkable for an economy with a big public sector, which was basically frozen for five months during a downturn in global markets.

With Spanish voters leaving neither the centre-left or the centre-right with a clear majority – what does the ‘hung parliament’ mean for markets and European politics?

0 Comments