Five Things We Watch For In 2024

We’ll start today’s 5 things with a look at the central bank outlook for 2024, then we’ll address the troubles for OPEC. We move over to talk about China and afterwards Ukraine for some geopolitics. Finally, we’ll end this year’s last 5 things with a crypto outlook.

1) Which Central Bank blinks first?

A key topic for investors in 2024 will be which central bank blinks first in the inflation battle and cuts rates.

Supply chains have largely eased (Look at freight rates from Shanghai to Rotterdam) and assuming that the conflicts in the Red Sea with Houthis attacking ships don’t escalate we do not see further pressures coming on that front.

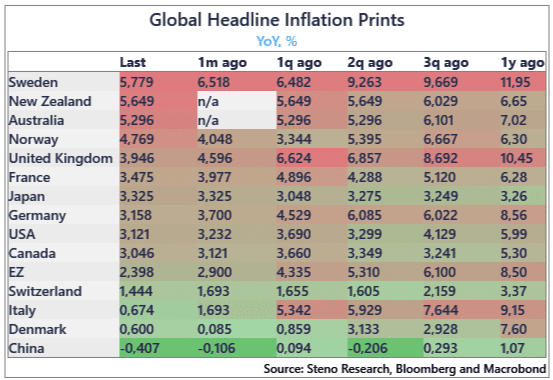

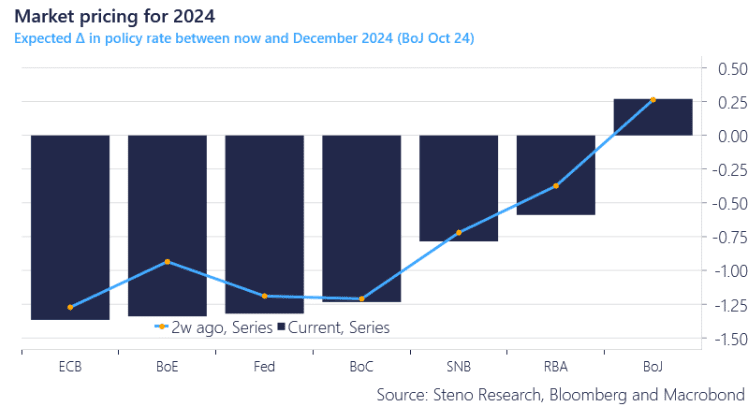

The thing to watch is probably employment numbers and once the labor markets start turning bad, expect CBs to cut in a hurry (Especially if it is in the middle of an election year, wink wink). After last week’s FOMC markets began front-running cuts and currently the Fed is priced to cuts at the same time as the ECB. Looking at chart 1.a and taking the easing of financial conditions post market pricing it doesn’t look likely to us that the Fed will be the front runner of this cycle. Another interesting country on this list is Sweden, whose inflation is double that of the EZ average, which is striking given its household’s sensitivity to rates. The reason is likely strong unions which have had their effects on services and healthy consumer balance sheets. We have dubbed Sweden the South Korea of Europe and expect a 2024 recession will bring down inflation to EZ averages.

The odd one out in terms of CBs is BoJ which is priced to hike among the major central banks. It is starting to smell like 2007 again with the BoJ late to the party starting to sound hawkish.

Chart 1.a: Breakdown of global inflation prints

Chart 1.b: Market pricing for major CBs

Welcome to the last 5 Things We Watch for this year, which we have decided to make a 5 Things We Watch for 2024 with an outlook on key topics for 2024

0 Comments