Emerging Markets: Legs to the Korea case or time to cash in?

We see growth trending higher in the cyclical parts of the economy through April on our models and nowcasts, and Korean industries are well-positioned to capitalize on global cyclical tailwinds. Especially as Chinese economic activity picks up pace. The Caixin PMI suggests expansion, and given trade ties and scarcity of semis this should, all else equal, continue to boost Korean exports.

Today’s shipping data from Shanghai may have disappointed, but in light of other recent data indicating otherwise, we see it as a short-term fluctuation in the larger context of recovery.

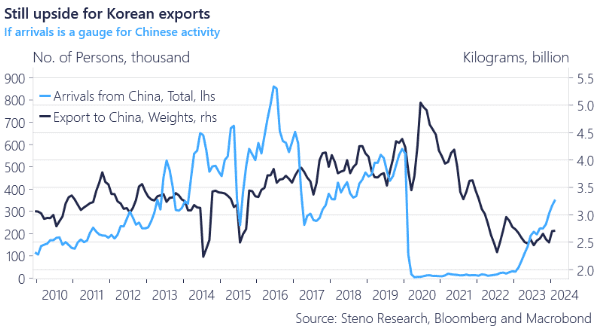

Korean companies are deeply integrated into global supply chains and stand to benefit as Chinese momentum continues. Especially if the consumer side of the Chinese equation follows developments in manufacturing. While not entirely square with pre-pandemic highs, the trend in Chinese arrivals in Korea does support such a development.

Even if the signs of a “head fake” in the cyclical growth patterns are increasing in significance, and despite today’s weakness in the Kospi (down 1.7%) likely influenced by the Taiwanese earthquake, we remain somewhat upbeat on the outlook for Korea’s economy and the equity index in the short term.

We are not as convinced on the longer term as some of the cyclical indicators with a 6-12 month lead have started weakening for H2-2024.

Chart 1: Chinese arrivals vs. Korean exports to China

Korea has, by first-hand experience, been a sell-side favorite, and the Kospi has been on a roll recently. Some leading cyclical indicators have started to turn however, and the question is then whether to book some profits in the region?

0 Comments