EM Watch: Is China making a fool out of Western metals speculants?

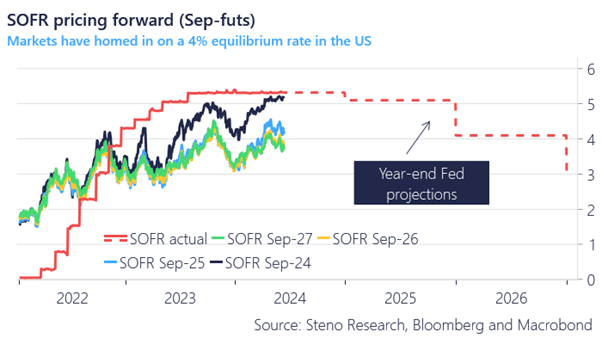

Hot on the heels of watching Powell’s press conference, which pushed back slightly against renewed rate-cut optimism, it’s clear that the Fed is playing a cautious game.

Despite the soft inflation data this morning, they significantly changed the dot plot. They likely believe the CPI report was noisy due to a sudden deflation in transportation. The labor market remains their best excuse to cut rates early, as any unexpected weakening can be framed as “worse than forecast,” even though their forecast is already flat.

The Fed will continuously grapple with base effects through the second half unless we see truly soft numbers. Today’s presser reminded us that year-over-year comparisons are all that matter to journalists. I maintain my base case of no cuts, and it seems the Fed is approaching that conclusion as well.

This macro backdrop has not made the Chinese copper conundrum less interesting. We better prepare for big market moves in metals into July.

Chart 1: The market is already (more than) aligned with Fed forward guidance

We are still observing China’s next moves in the copper market, as inventories at Chinese exchanges are booming while they are running low in the West. Meanwhile, our studies reveal that the physical demand in China is absolutely on the floor!

0 Comments