EM Stimulus Showdown: From Beijing with Boost to EM?

Welcome to this week’s edition of our EM-angled editorial, which comes hot on the heels of the PBOC Key Ministry Briefing. So, where better to turn first than China?

Findings in brief:

- More stimulus for the Chinese economy and markets

- Spill-overs to manufacturing/China sensitive geographies and currencies

- Both EM (particularly Asian) equity and FX appear cheap

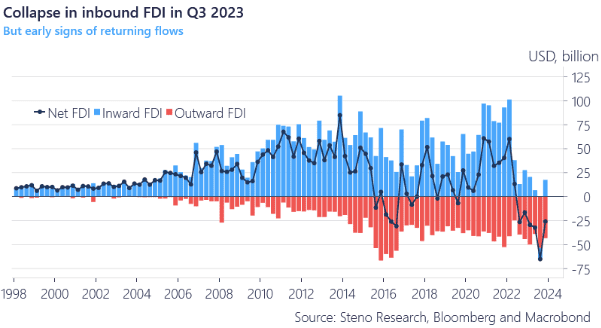

Overseas investors are showing hesitancy towards the world’s second-largest economy. Foreign direct investment in China witnessed its smallest increase since the early 1990s last year, posing challenges to building investor confidence.

PBOC Governor Pan underscored in the PBOC’s key ministries briefing that China will up regulatory and compliance frameworks and make the case for Chinese flows more attractive to foreign investors.

Latest Q4 2023 data does show some early return of appetite for Chinese exposure – likely in part as particularly India and Japan begin to look a bit stretched value and positioning wise – but ETF flows remain convincingly negative.

We like the relative r/r to some China revitalisation, albeit expressed via proxies. Leaving aside the long-term sustainability, authorities do not seem reluctant to use stimulus as necessary. EV the new RE?

Chart 1: Early resurgence in Chinese inbound FDI?

As indicators point to pro-cyclical US manufacturing trends, emerging markets are poised to catch the wave of economic momentum. We take a closer look at EM sensitivities and potentialities in this early tide.

0 Comments