Something for your Espresso: Yuuuuuuuge week ahead!

We have had a quiet start to the week ahead of a load of central bank decisions. Here is the brief summary of the key decisions for each of the central banks in question:

BoJ (Tues): Likely raising 10bp and axing ETF buying

RBA (Tues): Is the June cut actually in play?

Fed (Wed): Likely announcing time-line for QT tapering (probably already from June -> onwards) and revising the dot plot 1 hike higher for 2024 and potentially moving the long-term dot up?

PBoC (Wed): No cut to the MLF rate last week, but instead only to the Loan Prime Rate this week? (Screwing the banks NIM along the way)

BoE (Thurs): Acknowledging the progress on service-flation in January/February? (CPI Feb released a day ahead of the meeting)

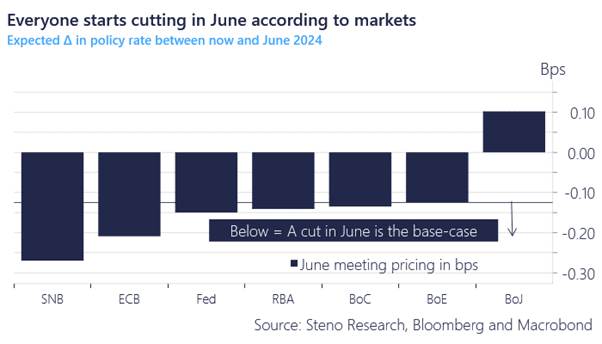

SNB (Thurs): Priced as the most dovish central bank for the June meeting

The consensus remains firm that June is the most likely timing of a big almost coordinated cutting action commencing, but we are getting close to 50/50 calls in the market pricing for quite a few of the big ones.

Chart 1: June meeting market pricing

We have an action-packed week ahead with action from almost all key countries for the global economy. Will volatility return as a consequence?

0 Comments