Something for your Espresso: You shall not pass!

Morning from Europe!

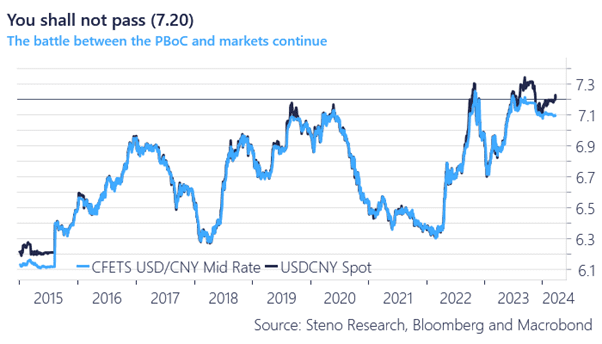

The PBoC has issued another firm “you shall not pass” message around the 7.20 handle in USDCNY this morning in the ongoing tug of war between the FX markets and the monetary authorities in China. Also, the Japanese monetary authorities have intervened rhetorically this morning leading Nikkei more than a 1% lower emphasizing that FX and Equities have a negative correlation in flows currently. We like the outcome space of CHFJPY shorts here, given the backing from both central banks in question

The PBoC took the CFETS fixing rate below 7.10 again after the move above 7.10 on Friday in conjunction with the selling pressure in the Yuan. The big question is how authorities intend on easing further without “letting the currency go” and the best thing that can happen for them is that the Fed eases the pressure from the USD side of the equation via rate cuts already from June and onwards, which is clearly debatable given our inflation models.

The current path risks turning into a light “doom-loop” as the intervention via the fixing will have to be backed by flows (selling of USD assets), which in turn risks creating a fixed income bearish USD rates environment reminiscent of the autumn of 2023.

We continue to favour paying USD rates, especially 3-5 years out, given this dynamic.

Chart 1a: Spot versus fixing in CNY markets

We see intervention in Asian FX markets from the morning, but could such activity turn into a headache for the Fed? Meanwhile, European inflation data is key during the shortened Easter week!

0 Comments