Something for your Espresso: USD liquidity stress. Will the Fed panic?

Morning from Europe.

After a few days on the road in London, I am back at the desktop in Copenhagen.

Impressions from 11 meetings in London over the past 48 hours

– Uniformity is growing in view of rates. Sharp move in positioning in rates rhyming with the “inflation is dead” narrative…

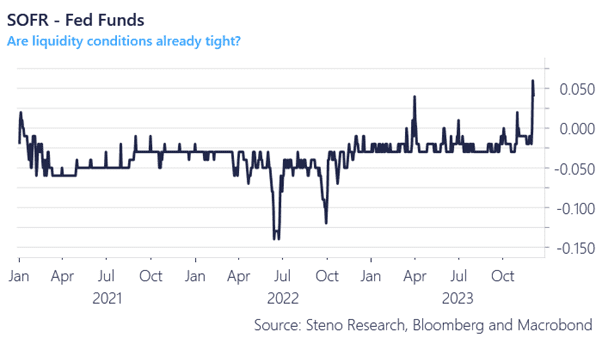

– … A lot of support for the idea/notion that SOFR-Fed Funds spreads reveal that USD Liquidity is not ample and that the Fed will have to end QT early

The latter, the spread widening in SOFR – Fed Funds, caught a lot of attention over the past days and it is interesting how swiftly the market jumps to the conclusion that it will lead to the Fed panic-ending QT already in Dec or January. Why are SOFR – Fed Funds spreads widening and how do we deal with it?

Chart 1: SOFR – Fed Funds spread

Loads of discussion over the past 48 hours on the spike in SOFR versus Fed Funds and whether it will lead the Fed to end QT early in a panic mode. We find it likely that the ON RRP will be depleted EVEN faster now.

0 Comments