Something for your Espresso: Trading the cycle..

Morning from Europe.

We’ve experienced significant success with our combined thesis, which includes 1) lower USD/JPY readings, 2) weaker metal prices, 3) improving high-beta risk sentiment in the equity space, 4) rising natural gas prices, and 5) payers in cyclical rates such as SEK and EUR.

It’s particularly telling that gold hasn’t performed well despite a series of bullish factors: the Chinese central bank cutting rates, Indian authorities substantially lowering customs duty on gold trade, and a weekend of bombing in the Middle East.

From discussions with peers, it appears that banks are now attempting to pitch the long gold trade to even bronze-tier private banking clients, which is typically very telling.

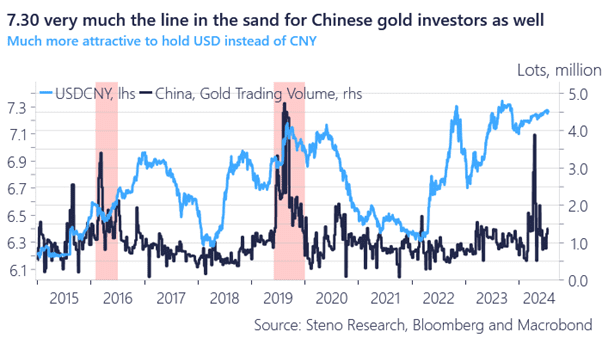

Positioning is heavily long, and the typical strong demand from Asia has dissipated, unless we see a breakout above the intervention zones in USD/JPY and USD/CNY, which currently seems unlikely.

Chart 1: Chinese Gold volumes typically recede once we see 7.30 as a line in the sand

We are starting to see some compelling risk/rewards in betting on higher interest rates again, not least in Europe. We will get news from the US Service sector today setting the scene for the nationwide PMIs later this month.

0 Comments