Something for your Espresso: The rates rollercoaster

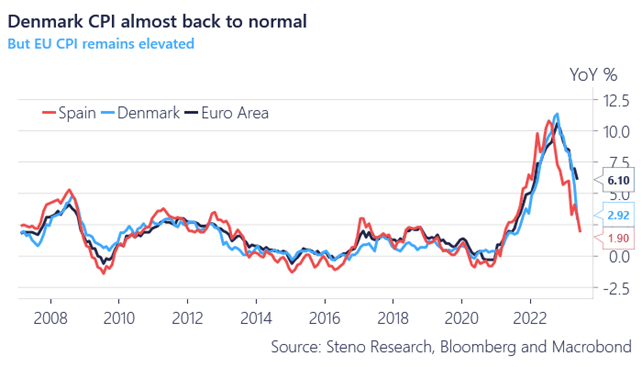

German and Spanish inflation numbers surprised marginally on the high side of expectations yesterday, but we still find trends benign if we set aside the monthly volatility in numbers.

German inflation is running at a 0.2-0.3% MoM pace (setting aside subsidies), which is much better than a few quarters ago and by the way also enough to take inflation towards the 2% handle soon given massive base effects towards the end of the summer. Spanish inflation is now officially below 2% both in harmonized and non-harmonized figures, which should bode well for European inflation in July and August.

Chart 1: Headline inflation will be back at target already within a few months

Just as the weak growth surveys in Europe had established a short-term downtrend in EUR rates, the inflation ghost is back wreaking havoc with that narrative. The inflation numbers from Europe were not that bad, but markets are heavily positioned in long bonds.

0 Comments