Something for your Espresso: The Japanese fear of becoming a release valve

Morning from Europe.

The JPY has gained a bit this morning as the chief FX diplomat, Masato Kanda, Vice Minister of Finance for International Affairs, has warned that intervention in JPY markets is a possibility again with levels above 145 in USDJPY.

We continue to see this pattern that USDJPY turns into a release valve everytime the PBoC draws a line in the sand around 7.30 on USDCNY. The fundamental spread case between USD and JPY is the same as for USD vs CNY, which means that the BoJ / Fiscal authorities need to match the intervention from the PBoC for the JPY not to turn into the release valve.

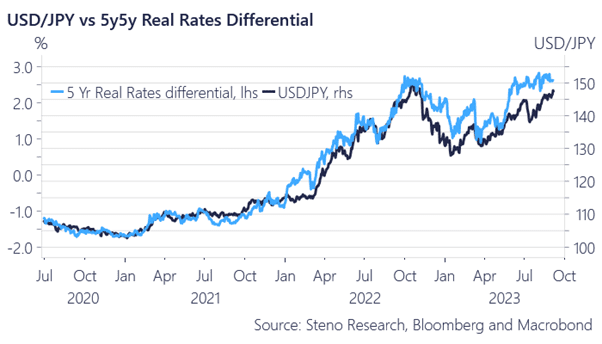

Both the PBoC and the BoJ fight gravity. USDJPY fair values > 150 from a real-rates perspective.

Chart 1: USDJPY fair value is probably above 150

Masato Kanda threatens with intervention in JPY as the Japanese case risks becoming the release valve for pressures in China. Equity markets behave as we expected given the renewed pressure >7.30 in USDCNY.

0 Comments