Something For Your Espresso: The higher for longer ghost is crawling back..

Morning from Europe

Both precious metals and equities recovered from the recent selloff yesterday, with USD strength diminishing and yields dropping a tad, putting a stop to the bleeding in Gold and Silver especially.

For equities, it looks like the recent correction was simply a tax question, as investors are buying the dip, sending broad indices up for the second day in a row, while VIX is sent packing from its recent 20

ish levels to 15. While rates expectations have been repriced to the hawkish side, earnings keep surprising to the upside – completely out of line with what you would expect with rates at 4.5-5% – which has allowed equity prices to stay elevated, despite receiving tailwinds from both commodity and rates markets.

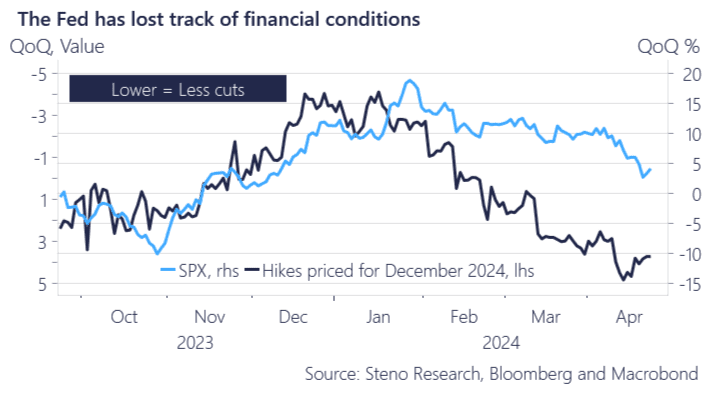

We still like tactical exposure to US equities given the likely continuation of the cyclical upswing in the US, but as we see it, there is one clear risk this year: that the Fed will make an attempt to regain control of financial conditions and intentionally cool the economy to reach the 2% target. Fed’s financial conditions index consists of 7 variables, including the 10 year yield, 30 year mortgage rate, Triple B corporate bond yields, equity prices, house prices and the dollar – most of which they have lost complete control of..

Chart 1: The Fed potentially needs to regain control of financial conditions

Equities are back on track amidst rates traders agreeing on 0 Fed cuts being increasingly more likely. Our short and sweet morning post here.

0 Comments