Something for your Espresso: Running on a broken Chinese engine?

Morning from Europe!

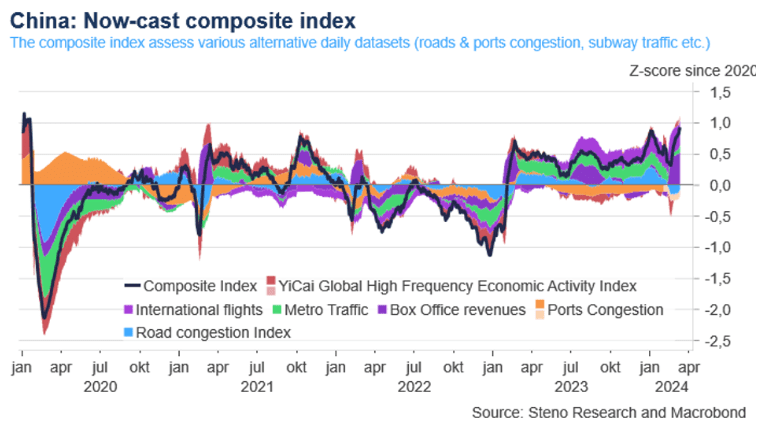

It seems like the risk on narrative is suddenly running solely on a broken Chinese engine now. We have been banging the drum on the rotation from Japan into China since last week’s rumors/stories on a March hike by the BoJ and it seems like the rotation continues. Our Chinese nowcast model is approaching 1+ std dev from reopening levels, which is the firmest signal of increasing activity in China over the past years

This rhymes well with an overall improving China sentiment in FX space and equity space over the past days. There is, in other words, some merit to this Chinese repricing even if it is admittedly early days.

Yesterday’s price action in US equities also confirmed that Materials is the China-proxy in US equity markets and it keeps performing in relative terms. China and partially South Korea were the only country-indices performing in USDs and Asian FX continues to look undervalued relative to e.g. European FX (in basket terms).

Being long KRW, MYR and AUD versus a basket of European FX seems like a sensible idea.

Chart 1a: China nowcast is improving

Suddenly markets have shifted towards repricing the Chinese outlook markedly versus the rest of the World. Is the global narrative suddenly running on a broken Chinese engine? Meanwhile, USD inflation is out!

0 Comments