Something for your Espresso: Pfandbrief, Achtung Achtung!

Morning from Europe!

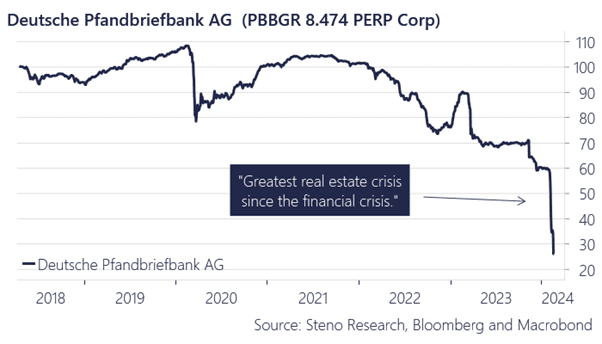

The spill-overs from the CRE crisis in the US are getting more and more pronounced in Germany. On Wednesday, Deutsche Pfandbriefbank called the crisis “the greatest real estate crisis since the financial crisis” in an unscheduled statement that included a message of increased provisions because of the “persistent weakness of the real estate markets.”

The question is whether this story holds the potential to turn into a broader EUR topic, and whether the ECB or the German authorities will be forced to comment. We have seen spill-overs to the Landesbank space over the past days with for example Landesbank Badem-Wuertemberg also feeling the heat in bond space.

As in the US, we are talking about medium-sized private banks or Landesbanks (regionally owned), which makes the risk of a systemic event low, but that does not exclude the probability of public intervention.

Chart 1: Achtung achtung

The spill-overs within German regional banks from the CRE crisis are increasing. Will this turn into a topic for the ECB or for German politicians?

0 Comments