Something for your espresso: Manufacturing on a roll (almost) globally

Good morning from Europe. We hope you’ve had a great Easter.

While consumer numbers remain weak, we’ve had a string of solid Chinese PMIs over the last few days. Most recently with the Caixin surprising modestly (51.1 vs. 51 est.) with the highest reading in more than a year (Feb 2023). This marks the fifth consecutive month of expansion, and it rhymes very well with our understanding of a rebound in China (as flagged in our nowcast) while European nowcasts remain mediocre at best.

Investors are growing increasingly optimistic about the performance of the world’s second-largest economy, and the benchmark CSI 300 Index rose 1.6%, the most in a month, to lead gains in Asia on Monday.

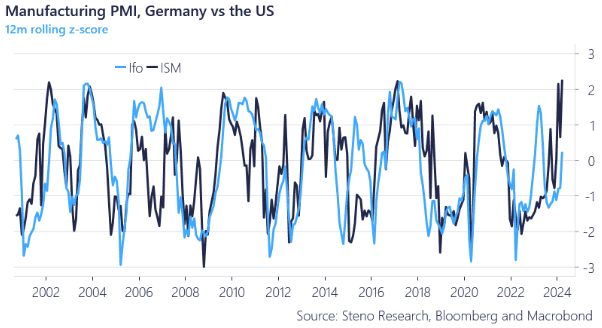

In the US, manufacturing is also solidifying recent strength with yesterday’s ISM PMI coming in at an expansionary 50.3 – that is well above the expected median survey of 48.3. This unexpected rise signals further cements that the ‘last leg’ of disinflation could be challenging, and the Fed following through on 3 cuts seems more and more unlikely – we see the probability of such about equal to the probability of no cuts for 24 at all.

Chart 1: US (and particularly Chinese pick-up) good for EZ

Manufacturing is on a roll globally, and the case for continued Chinese pick-up was emboldened during Easter. Is the strong US unequivocally good news though? Inflation is not done and dusted!

0 Comments