Something for your espresso: Equities to reverse the trend?

Good morning from Europe!

Last week marked the 3rd consecutive week lower for the S&P 500. A rare streak which has only occurred 24 times in the past decade – only 7 of which has extended to 4 straight weeks. Currently, earnings expectations have receded from 4% ahead of the reporting season to now only 2.4%.

Meanwhile, this week is the busiest week for the broad index in terms of Q1 earnings, and these will likely decide whether Friday will in fact make the 4th. Albeit early in the week, it bodes well for equities regaining some momentum. The SPX reclaimed the 5000 mark Monday with elevated activity in call options.

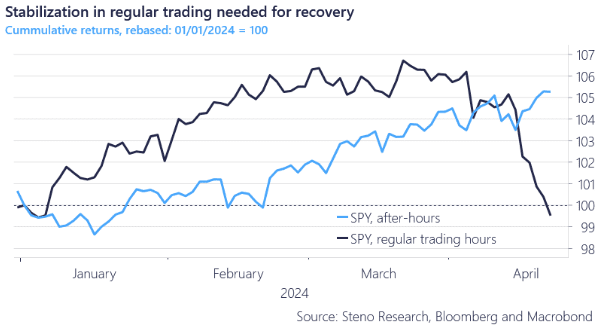

The lack of escalation of geopolitical tensions has somewhat supported risky assets yesterday, but recent volatility may keep investors cautious about buying any market recovery. The S&P 500 has fallen at the opening bell every day during its current slump. Cumulative returns during regular trading hours this year have dipped into negative territory.

Any significant market rebound hinges on a stabilization in opening hours, but technicals are improving, and we expect strong US consumption to be reflected in still strong earnings and a higher close for the week (in SPY at least).

Chart 1: SPY in regular- vs. after hours trading

Busy week in macro spiced up by reporting season. Will earnings provide some awaited relief for equities. We tend to think so.

0 Comments