Something for your Espresso: Central Bank Bonanza

It’s a big week in global central banking and both the Fed, Norges Bank, the Riksbank and the BoE will decide on rates this week. Some of the trends towards weakness/softness in European FX and rates seem a bit exhausted ahead of this week (confirmed by the market opening this morning), but with a few days of consolidation we may be back in a scenario that allows for renewed bets on weakness/softness from European central banks.

Overall, we see a decent risk/reward in expecting European central banks to sound somewhat more balanced after the ECB made the pause the explicit base-case, while the Fed is likely not willing to accept a notion that a pause is a base case from here with the recent reacceleration of inflation numbers.

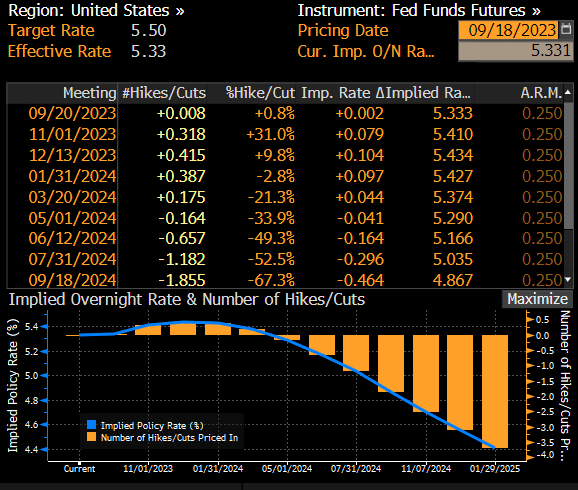

Fed pricing hints of a roughly 40% chance of a hike in December, which is probably also the timing of the still intended rate hike from the dot plot in June. We expect Powell to solidify the expectations of that hike still being the modal outcome from the Fed.

Chart 1: Fed fwd pricing

It’s a big week in global central banking and both the Fed, Norges Bank, the Riksbank and the BoE will decide on rates this week. Some of the trends towards weakness/softness in European FX and rates seem a bit exhausted ahead of this week (confirmed by the market opening this morning), but with a few days of consolidation we may be back in a scenario that allows for renewed bets on weakness/softness from European central banks. Overall, we see a decent risk/reward in expecting European central banks to sound somewhat more balanced after the ECB made the pause the explicit base-case, while the Fed is likely not willing to accept a notion that a pause is a base case from here with the recent reacceleration of inflation numbers. Fed pricing hints of a roughly 40% chance of a hike in December, which is probably also the timing of the still intended rate hike from the dot plot in June. We expect Powell to solidify the expectations of that hike still being the modal outcome from the Fed. Chart 1: Fed fwd pricing BoE market pricing has been falling off a cliff lately with March-2024 peak SONIA pricing falling from 6.50% down to only 5.54%. We have earlier labeled UK rates pricing to be the biggest misallocation in global fixed income and we continue to lean that way given the weakness seen lately in services related gauges in the UK. We ought to remember that the smoking hot wage growth numbers […]

0 Comments