Something for your Espresso: Bye bye, 155…

Morning from Europe!

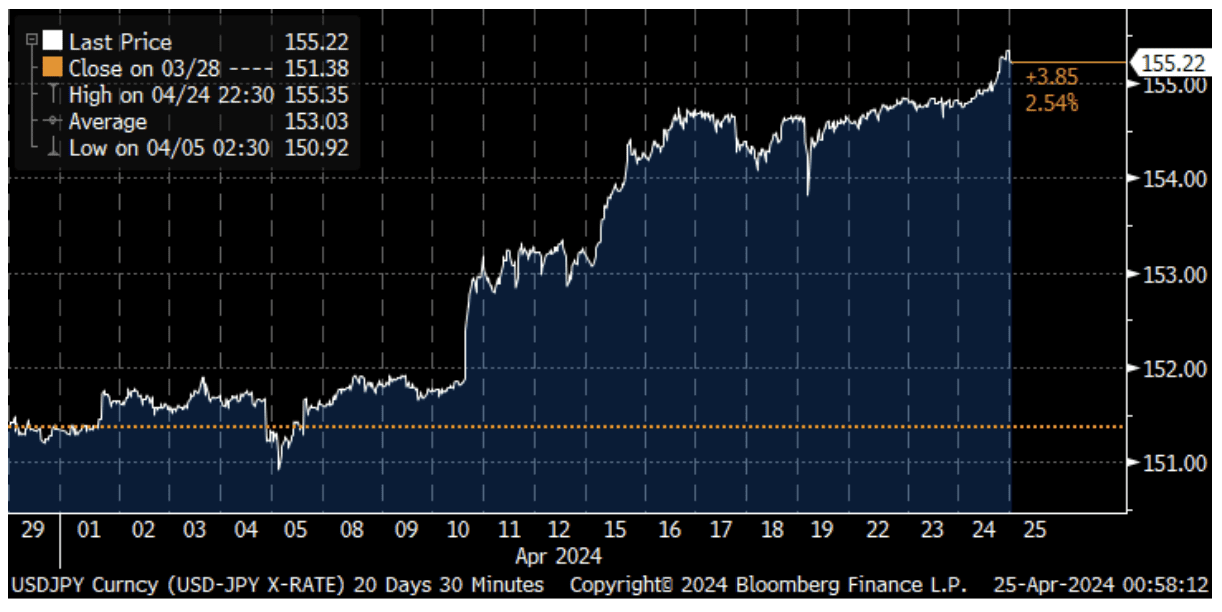

USDJPY is sitting comfortably above 155 now without a response from the monetary authorities. This is the first sign that the BoJ hawks are throwing in the towel ahead of the meeting this week.

As per usual, we have seen a buildup of expectations ahead of the meeting and as per usual the BoJ meeting tomorrow will likely end in tears for the JPY bulls.

The BoJ seems complacent or even satisfied with the current trajectory of USDJPY as it allows them to remain on a “normalization” path without risking a derailed inflation picture because of a landslide in imported inflation. The last thing Ueda and his ilk want right now is a sharp reversal lower in USDJPY, especially as the last inflation report made for very soft/dovish reading.

Allowing the USD side of the equation to dictate price action (even as the Fed cuts are being rolled back) seems like the play from the BoJ. Meanwhile USDCNH is creeping higher.. Is a weak JPY towards the weekend the final excuse needed for the PBoC to conduct a managed devaluation of the CNY?

Chart 1: Bye bye, 155..

The pressure is mounting in USD vs Asian FX and if the BoJ disappoints JPY bulls, the PBoC action is probably imminent. The main culprit remains the USD side of the equation.

0 Comments