Something for your Espresso: Bear Stearns 2.0?

Good morning,

I haven’t gotten a lot of sleep due to the SVB-gate unfolding. While Silicon Valley Bank is around the 18-20th largest bank in the US, it has an extreme reliance on deposits in the funding model relative to other banks (89% on the latest publicly available data).

We can conclude that several VCs have been telling portfolio companies to withdraw deposits, why this arguably looks like a semi-bank-run on the surface by now. Banks with a heavy tilt in the funding model towards deposits are likely to suffer from the current trends towards pulling deposits to park excess cash in higher yielding bills or similar. From anecdotal evidence it is still possible to get money out as of this morning, which means that bank clearly still operates normally at thus juncture.

SVB already has a loan of 15bn USD at the local Federal Reserve home Bank (which is 20% of the total San Fran FHLB lending exposure), which limits the possibility of further “bailouts” – at least unless something is coordinated out of Washington DC. The total size of uninsured deposits is around $150bn, which is obviously a large number but still of a size with relatively limited contagion-potential.

Stay alert today. If a bank goes bankrupt, it always happens on a Friday late afternoon after close.

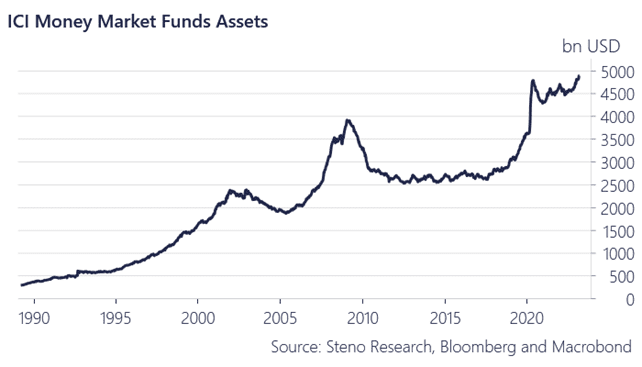

Chart 1. Money Market Fund Assets keep surging

This speaks in to the broader trends of more and more USDs being parked in bills and/or money market funds, which means that typical deposit-funding models are being tested. As deposits fled, SVB had to sell some of its bond holdings to fill the funding gap. This also means that they have to realize losses of bonds that were otherwise marked as hold-to-maturity in accounting terms. This is a potential snowball effect.

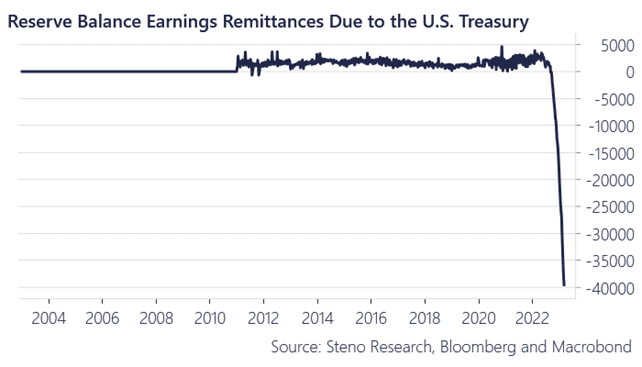

Just for reference, here is the running earnings remittances of the Fed.

Chart 2. Earnings remittances due to the US Treasury on a weekly basis (Million USDs)

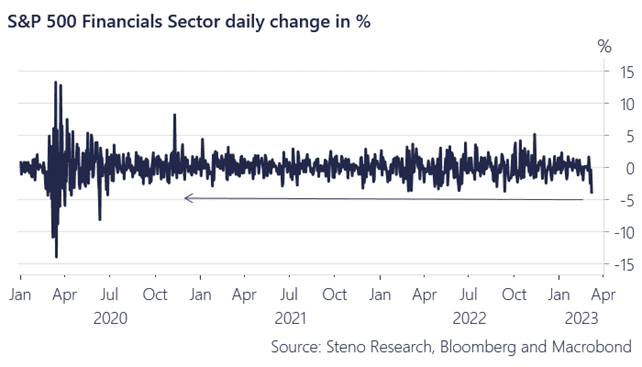

Yesterday marked the largest drop on a daily basis in the US Financial Stocks since the pandemic turmoil in March-2020, but we are thankfully yet to see full-blown panic.

First, the size of SVB is manageable. Second, the employment in related industries of clients of the SVB (mostly Tech) is not significant in a broader economic setting… But the question is if this is of relevance as a canary in the coalmine.

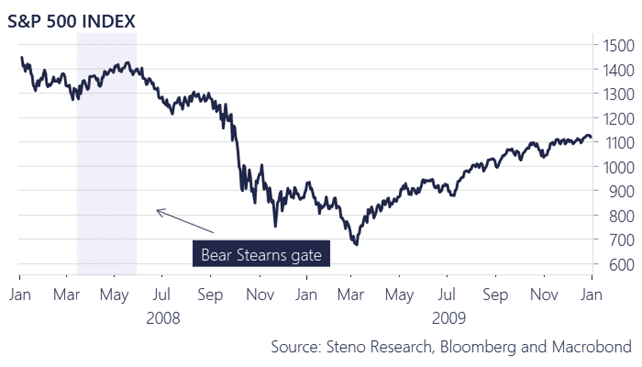

Is this Bear Stearns 2.0? There are some similarities size-wize (although Bearn Stearn was more significant). Remember that Bearn Stearns was initially offered a bail/loan of $25bn by the FRBNY. FRBNY soon after pulled the loan offer until JP Morgan purchased Bear Stearns in a deal that included the creation of Maiden Lane LLC that the FRBNY agreed to bail.

Chart 3. A large drop in US financials.. but how big are contagion risks?

It is tempting to construe this as a signal that the economic cycle are running on the absolute last fumes, but I need to remind you that the equity market actually weathered the Bear Stearns storm well, until the ultimate showdown around Lehman.

A bail-out of some sort is to be expected in this case if push comes to shove. No one is willing to allow a Lehman 2.0 on their watch.

Chart 4. S&P 500 during the Bear Stearns gate

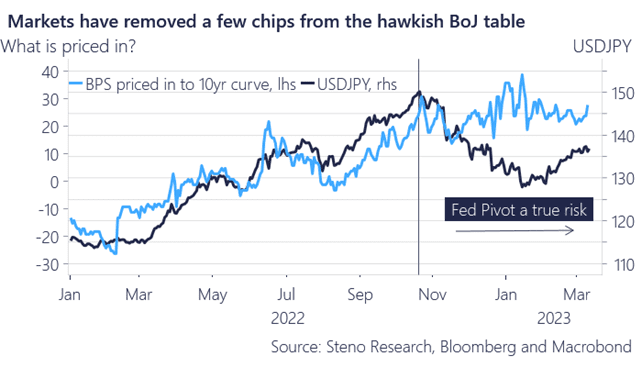

Finally, Kuroda-san basically passed the batton to Ueda-san without any major news this early morning. The BoJ is doing whatever it can to persuade market participants not to bet against their YCC-policy by for example limiting the securities lending program and the curve is basically almost out of function around the 10yr sector as a consequence.

Over to you Ueda… JGB yields are down, but the market remains firm on it’s pricing of a 25bp increase of the YCC program.

Chart 5. Over to you Ueda-san

1 Comment

Thanks Mr STENO this is the long awaited pivot happening record speed while the market was nursing their wounds from Tuesdays Powell broadside .