Something for your Espresso: Are we suddenly using AI as an excuse for everything?

Morning from Copenhagen!

The AI wave is suddenly used as an excuse for everything. Copper is trading through the roof because of AI, Utilities are no longer treated as a duration asset because of AI and the equilibrium interest rate is rising because of AI. The list goes on and on and on, but is it really fair?

The FOMC meeting minutes sounded like something I could have written on our Bloomberg chats in recent months. Several members of the committee started sounding the alarm on the FCI loop and whether too easy conditions could lead to a flare up of inflation.

On the other hand, several members also saw AI as a potential Goldilocks addition to the economic mix, as it “raises growth without raising” inflation. The former is probably more of a 2024 discussion than the latter and markets also took Minutes as a semi-hawkish reminder that at least some members of the FOMC are unwilling to paint a heavily left-skewed outcome space for SOFR rates.

Key quote from the meeting minutes:

“A number of participants noted uncertainty regarding the degree of restrictiveness of current financial conditions and the associated risk that such conditions were insufficiently restrictive on aggregate demand and inflation. Several participants commented that increased efficiencies and technological innovations could raise productivity growth on a sustained basis, which might allow the economy to grow faster without raising inflation.”

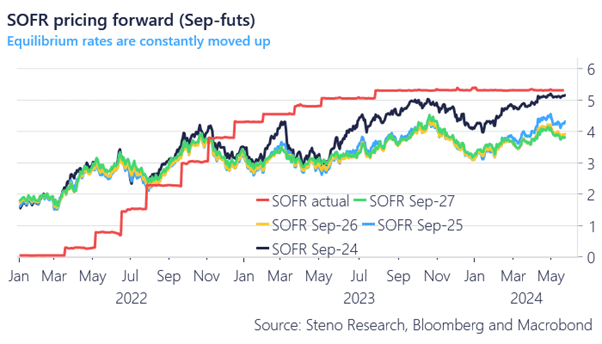

We still consider the “high for longer” undervalued in futures pricing of SOFR in 2025/2026 and expect to see a continuation of the FCI loop until the September meeting (at least) as Powell is de facto politically hand-cuffed to his “cuts are much more likely than hikes” narrative.

Chart 1: Forward pricing of SOFR rates

The AI wave is suddenly used as an excuse for right about everything in equity markets to commodity markets to rates markets. Is that even fair?

0 Comments