Something for your Espresso: 3 take-aways from the CPI report and the repercussions

Good Morning from Europe.

Quite a decent reception for the US inflation report as the curve steepener is back in fashion. We wrote in our preview that a cocktail of higher annualized headline inflation paired with lower annualized core inflation would prove to be an odd steepener cocktail, which has so far proven to be the correct take-away.

We only have four major periods to compare with since the 1960s and the two latest periods of higher headline paired with lower core inflation has indeed led to a steeper yield curve, as the cyclicality of the rising headline inflation has been reflected in the long end of the curve.

The bear steepener is BACK and it remains our short-term base-case that the front is almost glued to current levels with little action to be expected from the Fed, while the long-end of the curve will respond to 1) the (small) cyclical rebound and 2) increased duration issuance from the US Treasury.

Remember that a bear steepener is not necessarily bad news for risk assets initially as the pro-cyclical forces will drive up the parts of the equity markets that have an embedded cyclical tilt.

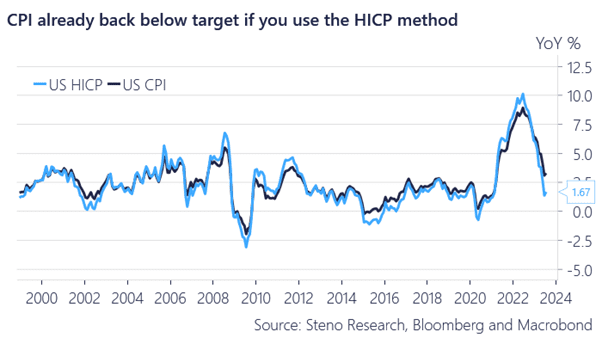

Chart 1: Is inflation already at or below target in the US?

We see three clear take-aways from the current inflation trends. The most important conclusion is that the US inflation is much LESS likely than the EUR inflation to print below target in 2023 and this will likely impact markets substantially in both the US and Europe.

0 Comments