Crypto Moves #34 – The U.S. Ethereum Spot ETFs Are Not Priced In

Just over a month ago, on May 23, the U.S. Securities and Exchange Commission (SEC) approved U.S.-based Ethereum spot ETFs. However, these ETFs have not yet launched because the SEC still needs to approve the necessary S-1 filings, in addition to the already approved 19b-4 filings from May 23. This final approval is largely a formality, suggesting that a launch is imminent.

Rumor has it that the ETFs are likely to launch next week, possibly on Tuesday, July 2. This speculation follows several amended S-1 filings submitted by the issuers in recent weeks, which have received minimal comments from the SEC. The expectation is that the ETFs will go live the day after the SEC approves the S-1 filings.

Recently, there has been intense debate among crypto thought leaders about whether the Ethereum ETFs will achieve success similar to the recently launched U.S.-based Bitcoin ETFs. Most experts are skeptical about the prospects for the Ethereum ETFs. Notably, Bloomberg ETF analysts Eric Balchunas and James Seyffart have predicted that the Ethereum ETFs will capture only 10% to 20% of the inflows that Bitcoin ETFs have seen. This prediction is significant as these analysts are highly regarded in the market.

Chart 1: U.S. Ethereum Spot ETFs Pessimism

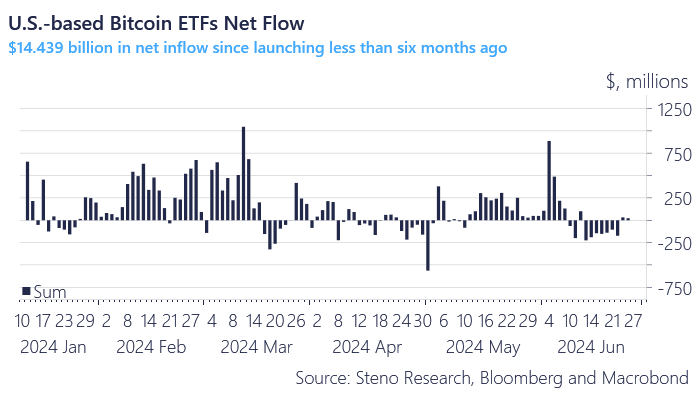

With a net inflow of $14.439 billion in nearly six months, a 10% to 20% share of the Bitcoin spot inflow would equate to around $1.5 to $3 billion for the Ethereum spot ETFs within the same period. This would render the Ethereum spot ETFs unsuccessful, especially when compared to the highly successful Bitcoin ETFs. The latter has been successful even when accounting for inflows driven by basis trading, as discussed in Crypto Moves #32, and the potential selling of spot Bitcoin to long the ETFs.

Chart 2: Weekly U.S.-based Bitcoin spot ETFs Net Flow

The performance of these imminent Ethereum spot ETFs is crucial for the price of Ethereum and the ETH/BTC ratio. Strong ETF performance will not only create direct buying pressure but also stimulate indirect buying, encouraging other market participants to acquire Ether if the ETFs show substantial net inflow.

Despite the general market pessimism about Ethereum spot ETFs, we remain as optimistic as ever. We continue to forecast a net inflow between $15 billion and $20 billion in the first 12 months, even considering the outflow from the Grayscale Ethereum Trust. This is compared to our expected net inflow of $30 billion to $40 billion for Bitcoin spot ETFs in their first year. Given this strong anticipated Ethereum inflow, along with other factors, we predict Ethereum will reach at least $6,500 later this year.

If our assessment of a strong Ethereum ETF inflow is correct, the ETH/BTC ratio should increase significantly. We maintain our prediction that ETH/BTC will hit 0.065 later this year. This is largely because we believe the market shares the prevailing pessimistic view on Ethereum ETFs, as highlighted by the following observations.

Firstly, the SEC’s approval of Ethereum ETFs in late May took the market by surprise (other than us, of course).

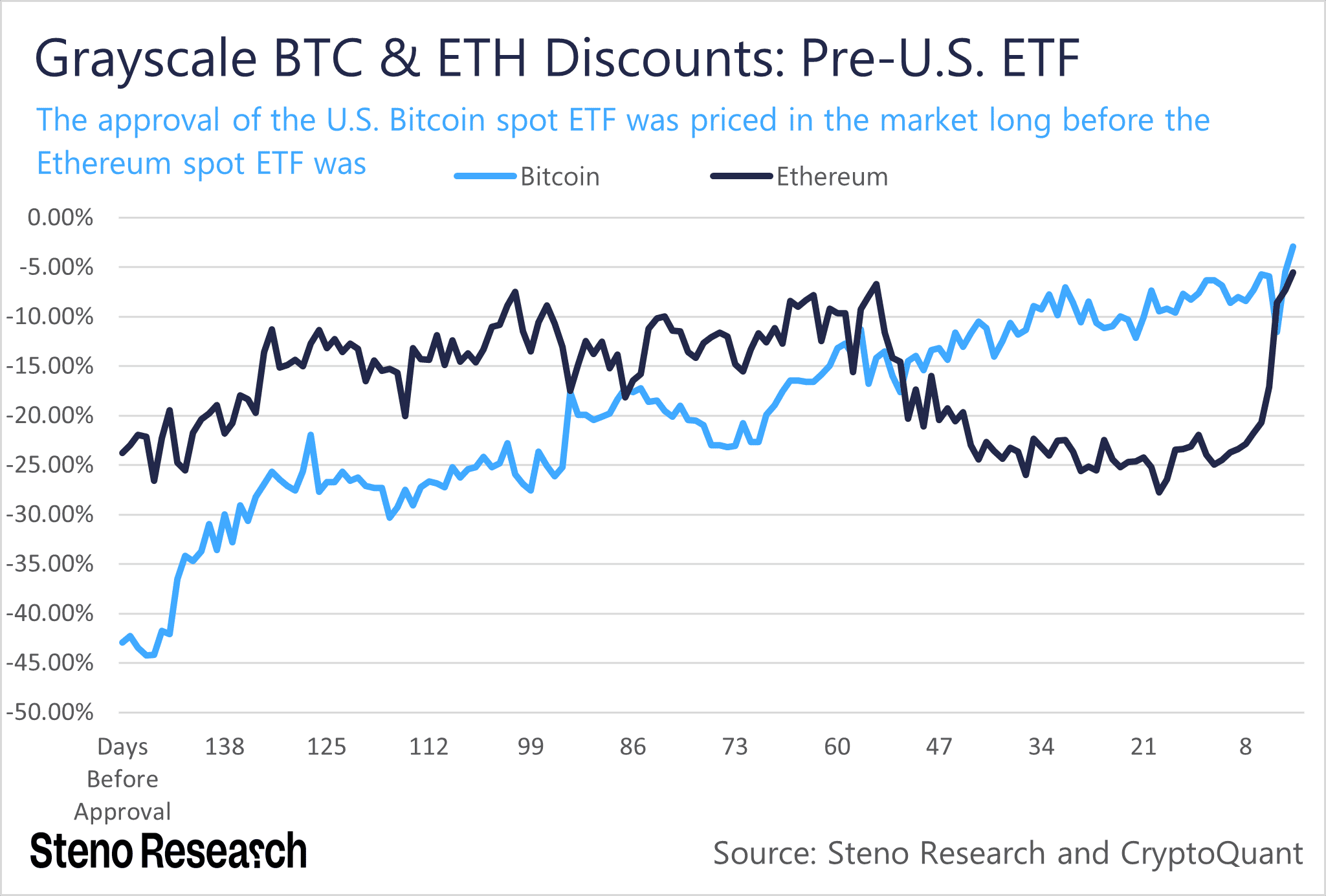

The best indicator of market expectations for ETF approvals has been the discounts on Grayscale Bitcoin and Ethereum Trusts. A week before the SEC approved the Bitcoin spot ETFs in January, the Grayscale Bitcoin Trust traded at an -8.40% discount relative to its net asset value. In contrast, in late May, a week before the Ethereum ETF approval, the Grayscale Ethereum Trust traded at a -22.9% discount. In the months leading up to approval, the Grayscale Bitcoin Trust consistently traded at a much lower discount compared to the Grayscale Ethereum Trust.

Chart 3: Grayscale Bitcoin and Ethereum Trust Discount Pre-U.S. Approval

The market’s outlook on the upcoming Ethereum spot ETFs is overly pessimistic. We anticipate a net inflow of $15 to $20 billion within the first year, as Ethereum possesses qualities that appeal to Wall Street. This should drive its value significantly higher, not only in dollar terms but also relative to Bitcoin.

0 Comments