Crypto Moves #30 – The European Union’s MiCA Removes Tether from the Market

Recently, we have discussed the significant positive shift in the U.S. regulatory environment for crypto. You might be weary of regulatory discussions, but we need to address the European Union’s Markets in Crypto-Assets Regulation (MiCA) framework. This framework is set to take full effect on December 30, 2024.

However, a subset of these regulations, specifically Titles III and IV, will come into force sooner – on June 30, 2024. These particular laws focus on stablecoins.

We will delve into the entire MiCA framework later this year, but for now, our focus will be on the aspects being implemented next month and their potential impact on the industry. These changes could be quite significant. In our Crypto Moves #9, published in early January, we referred to these specific MiCA regulations as a joker in our 2024 crypto outlook. Since then, they have proven to be even more pivotal than we initially thought.

We will explain the reasons behind this shortly, but first, let us clarify what these changes entail.

Regulating the cornerstone of crypto

There is no doubt that stablecoins are the cornerstone of the crypto world. They are the essential glue holding the market together. Most crypto trading volume involves stablecoins, as many participants first convert their native fiat currencies into stablecoins. This allows them to engage with more liquid trading pairs and use exchanges that do not support fiat currencies.

The widespread adoption of stablecoins has significantly enhanced market efficiency, enabling market makers and traders to swiftly transfer fiat-pegged cryptocurrencies for arbitrage opportunities. Stablecoins are crucial not only for maintaining a liquid and efficient market but also as the largest real-world use case for crypto. They are extensively used in cross-border transactions, remittances, and payments. Additionally, stablecoins are fundamental to many other crypto use cases, such as decentralized protocols and decentralized trading.

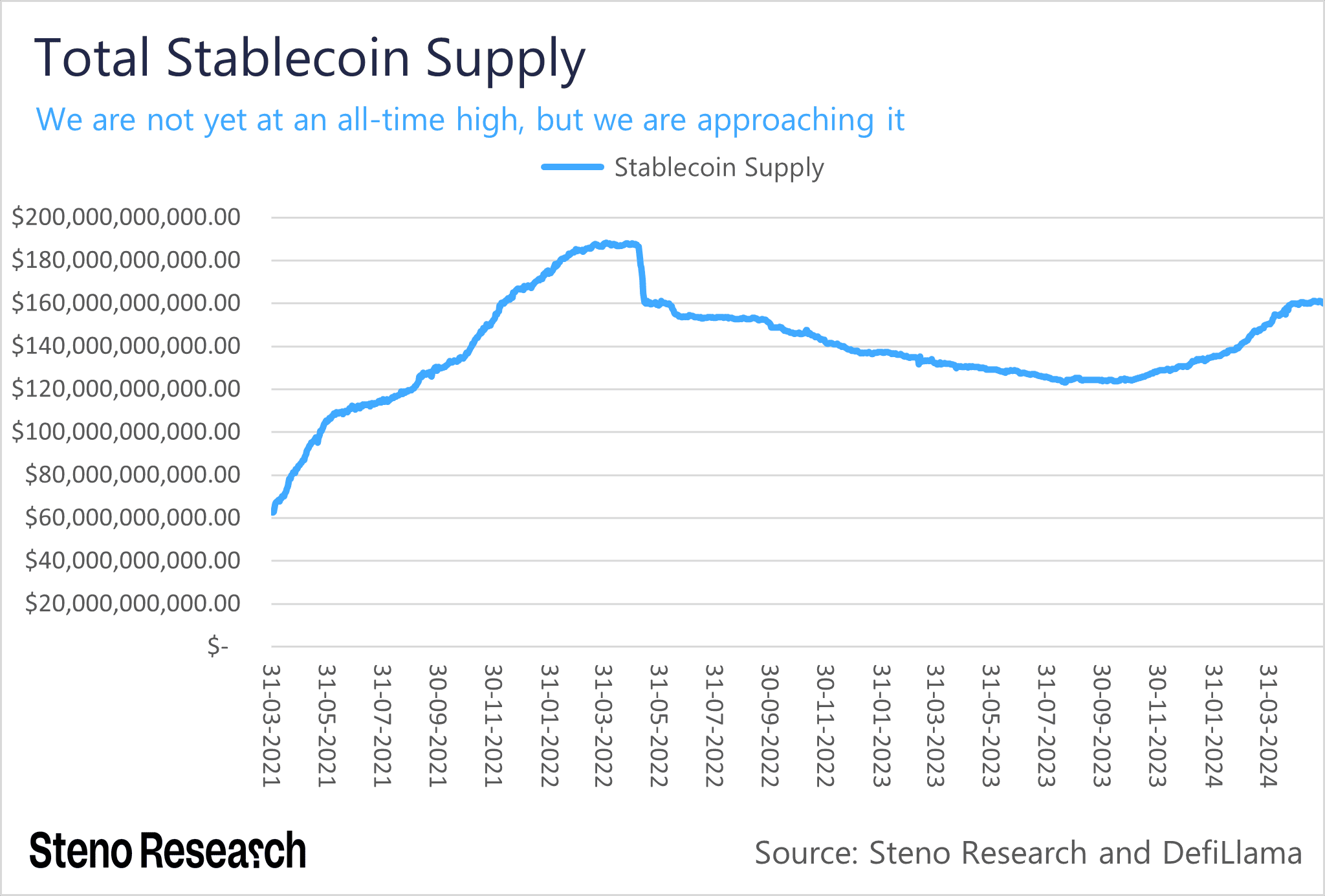

Stablecoins are simply the cornerstone of crypto, and there are no signs of this changing in the foreseeable future. The pivotal role of stablecoins in the crypto market is evident from their supply growth, as shown in Chart 1. If the supply rebound continues at this pace, we may reach a new all-time high within the next year, even in the current high-interest rate environment compared to 2021.

Chart 1: Total Stablecoin Supply

We strongly expect that exchanges will need to delist the world’s largest stablecoin, Tether, for all residents within the European Union exactly a month from now. This will be negative in the near term as it fragments liquidity and ecosystems. However, in the long run, it is positive as it reduces what is arguably the largest systemic risk in the crypto market.

0 Comments