Crypto Moves #36 – Give the Ethereum ETFs a Week, Then It Is Up Only

The U.S.-based Ethereum spot ETFs were launched on Tuesday, concluding their second trading session yesterday. Since the launch, Ethereum has declined slightly both in dollar terms and relative to Bitcoin. Despite this situation, there is nothing to fear – in fact, quite the opposite, as we will demonstrate in today’s Crypto Moves.

While it may seem premature to draw any conclusions about these Ethereum ETFs, we believe in analyzing market environments even with limited information, particularly when there is significant potential at stake, as with these ETFs.

We are confident that Ethereum will experience a similar impact from its ETFs as Bitcoin has, as discussed in Crypto Moves #34. The sooner we treat this as a fact rather than a conviction, the better positioned we will be to capitalize on it. If we are correct, the recent two-day downtrend in Ethereum presents a prime buying opportunity.

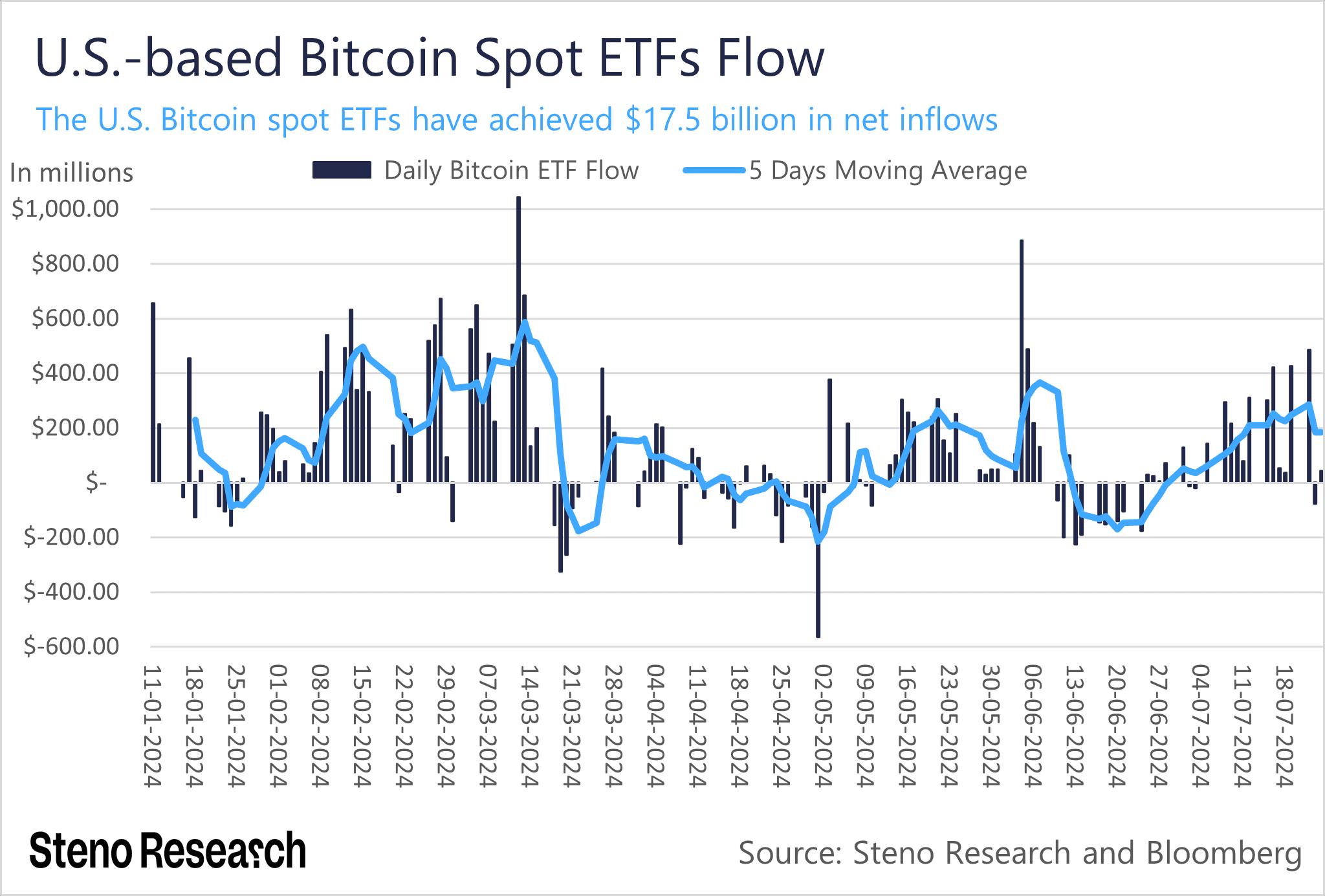

The launch of Bitcoin ETFs in January provides a useful comparison, making this time around even more intriguing and analyzable. Let us first review what Bitcoin ETFs have achieved in the past six months since their launch to highlight the potential impact of these ETFs. Bitcoin ETFs have collectively attracted a net inflow of $17.5 billion, despite the Grayscale Bitcoin Trust ETFs experiencing billions of dollars in outflows. This is a remarkable achievement.

Chart 1: U.S.-based Bitcoin Spot ETFs Flow

Let us see if the Ethereum ETFs can achieve anything similarly remarkable in six months.

Look at Grayscale

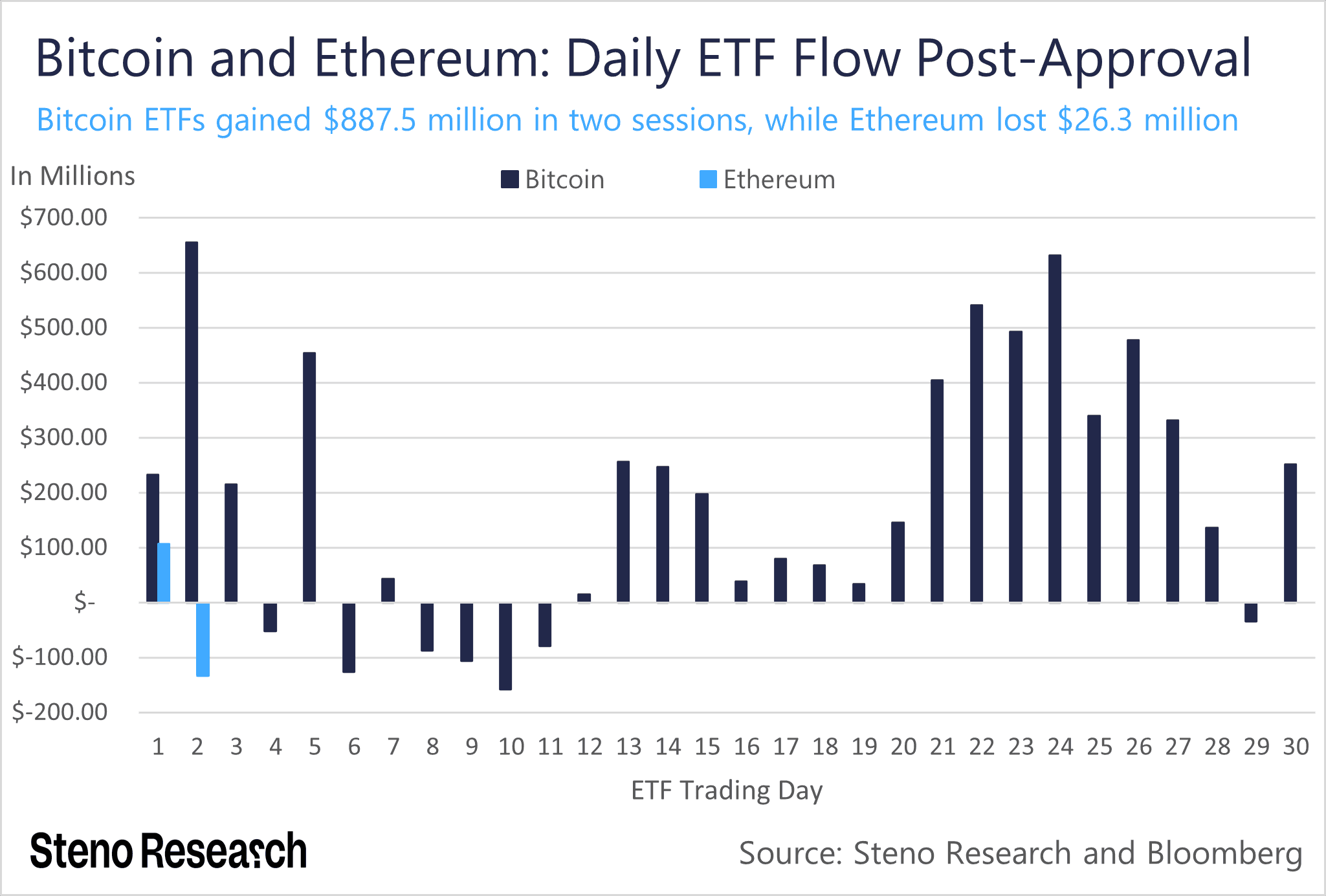

In their first two trading sessions, the Ethereum spot ETFs have collectively experienced a net outflow of $26.3 million, whereas Bitcoin ETFs saw a net inflow of $887.5 million in the same timeframe.

Chart 2: Bitcoin and Ethereum Daily ETF Flow

At first glance, this flow data from the initial trading sessions of the Ethereum ETFs may seem extremely disappointing, but there is more to the story.

The Ethereum price has dipped slightly since the launch of its U.S.-based ETFs, primarily due to significant outflows from Grayscale. There is no reason to consider the ETFs a failure despite the slight net outflow. In fact, this situation presents a prime buying opportunity.

0 Comments