Crypto Moves #31 – Do Not Fear Mt. Gox Repayments

It should come as no surprise that 2022 was rife with contagion in the crypto industry. Numerous crypto companies went bankrupt, many due to fraud. Now, the majority of these bankruptcy cases are nearing their conclusion, and some have already been completed, allowing creditors – primarily clients with assets stuck in these firms – to receive the remaining assets. These imminent repayments mean market participants will be repaid either in cash or directly in cryptocurrencies, also known as in-kind.

This note focuses on these repayments rather than the bankruptcies themselves, as the bankruptcies have little impact on the future markets. Instead, the repayments could influence the market through either buying or selling pressure. Cash repayments are generally bullish because they provide market participants with more liquid funds to acquire crypto assets. Conversely, in-kind repayments are typically bearish because they may release previously locked crypto assets into the market.

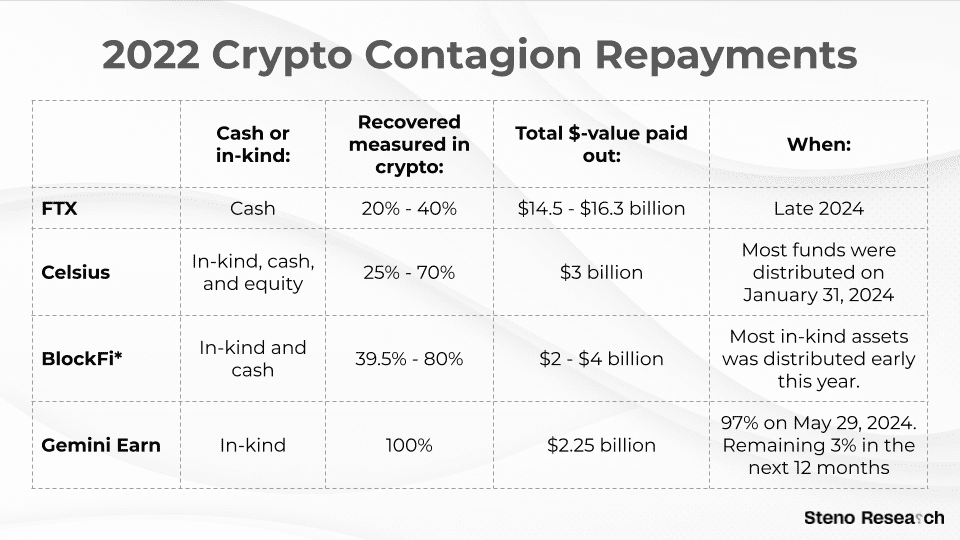

Here is what we know so far about the repayments from the four most high-profile collapses of 2022:

Chart 1: 2022 Crypto Contagion Repayments

Let us begin with BlockFi, Celsius, and Gemini Earn. All these estates are nearly settled, especially regarding the promised in-kind payments to creditors. Earlier this year, Celsius and BlockFi compensated creditors with in-kind crypto assets, while Gemini Earn, in partnership with the bankrupt crypto trading venue Genesis Trading, returned nearly all assets at the end of last month. The remaining assets that BlockFi and Celsius need to return are already in cash, meaning no further liquidation of crypto assets. This suggests that none of these three bankruptcies should impact the market moving forward, which is a positive sign.

Next, we have FTX, the largest case by far. The FTX estate has decided to distribute creditors’ claims entirely in cash, primarily because FTX had few remaining crypto assets when it filed for bankruptcy in November 2022. Instead, it held illiquid venture investments, real estate, and notably, a substantial locked Solana investment. Most of these have already been converted to cash, which is expected to be paid to creditors by the end of this year, totaling between $14.5 and $16.3 billion. This is bullish as it indicates no further crypto will be sold off from the FTX estate, and creditors will be compensated in cash, which they might use to acquire crypto assets.

However, there is another bankruptcy case that significantly unsettles the market. This case did not occur in 2022 but rather ten years ago, in 2014. It is not only the oldest case but arguably the most famous one.

Mt. Gox: The ultimative non-voluntary hodl

Launched in July 2010, Mt. Gox was a Bitcoin exchange founded by American programmer Jed McCaleb, and acquired by French developer Mark Karpelès in March 2011. Over the following years, Mt. Gox became the leading Bitcoin trading venue.

There is no reason to fear the imminent Mt. Gox repayment to creditors. Instead, you should be encouraged by the extremely positive developments happening right before our eyes. In this note, we compare these factors with the Mt. Gox estate situation.

0 Comments