Crypto Moves #1 – The Best Time Is Whenever Nobody Cares

This very first edition of Crypto Moves is freely available. However, from next week on, you need to have a crypto or premium subscription to be able to read it. Please use the code ‘crypto20’ until the 1st of December, 2023, to get 20% off your first 3 payments. Subscribe right here

My name is Mads Eberhardt. Despite my fairly young age, I have spent about 8 years in crypto, of which many are professional. My parents, though, do not call it eight years, instead, they call it way too many years. They argue for a real job, rather than an industry notoriously known as the black sheep to the financial industry. The latter is particularly the case considering that crypto firms have been going bankrupt one after another over the past year and a half, in which cases fraud has often been present in one way or another. I cannot deny that the industry has been a mess recently nor will I try to defend it.

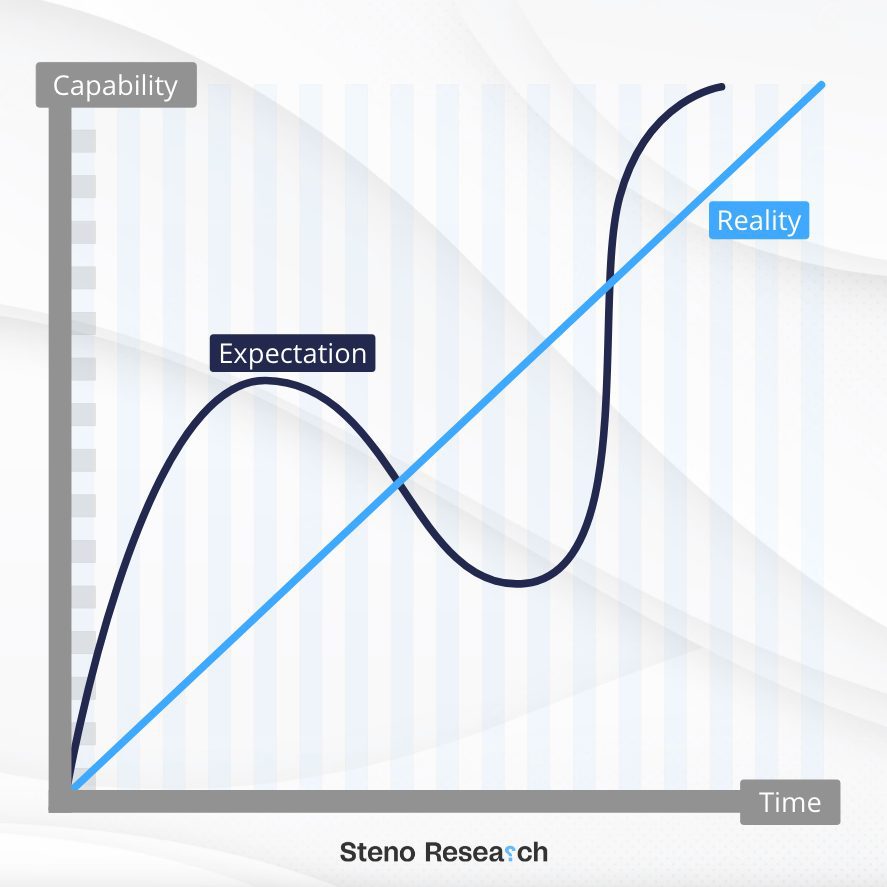

What I defend, though, is crypto itself. I am more positive about crypto than ever. That sounds surprising to most, so let me explain. The crypto market has so far experienced many cycles of utter greed and fear, respectively. In each of these cycles, there has been a severe mismatch between crypto’s technological capabilities and the expectations of the very same, depending on the degree of greed or fear in the market. At times of greed, the market’s expectations of crypto’s technological capabilities greatly exceed reality, whereas the complete opposite is true while fear is dominate.

All the while, crypto continues to technologically advance, no matter the stage of the cycle. This allows the asset class to gradually become more potent, but all, aside from a few die-hard crypto fans, appear to miss this advancement in bear markets. The majority can simply not see the forest for the trees amidst crypto bear markets, largely viewing the market as dead as a doornail.

Chart 1: The Crypto Progress Chart

The most recent case was the bear market of 2018 and 2019. Nobody was interested in crypto at that point, following an at the time unprecedented bull run of 2017. In 2018 like 2017, I had my own crypto brokerage. There was absolutely no flow of new money into crypto in 2018, but oh dear, there was significant outflow towards the nearest exit door.

In the same year, the Ethereum Foundation awarded a modest $100,000 grant to a small project striving to launch a decentralized exchange. The project launched in November 2018 and quickly gained traction but merely among the very few people still in crypto at the time. The project was, and still is, called Uniswap. You do not have to know much about crypto to know what Uniswap is, but in 2018 and 2019, few knew what it was, or more importantly, saw the prospects of the technology in the short term.

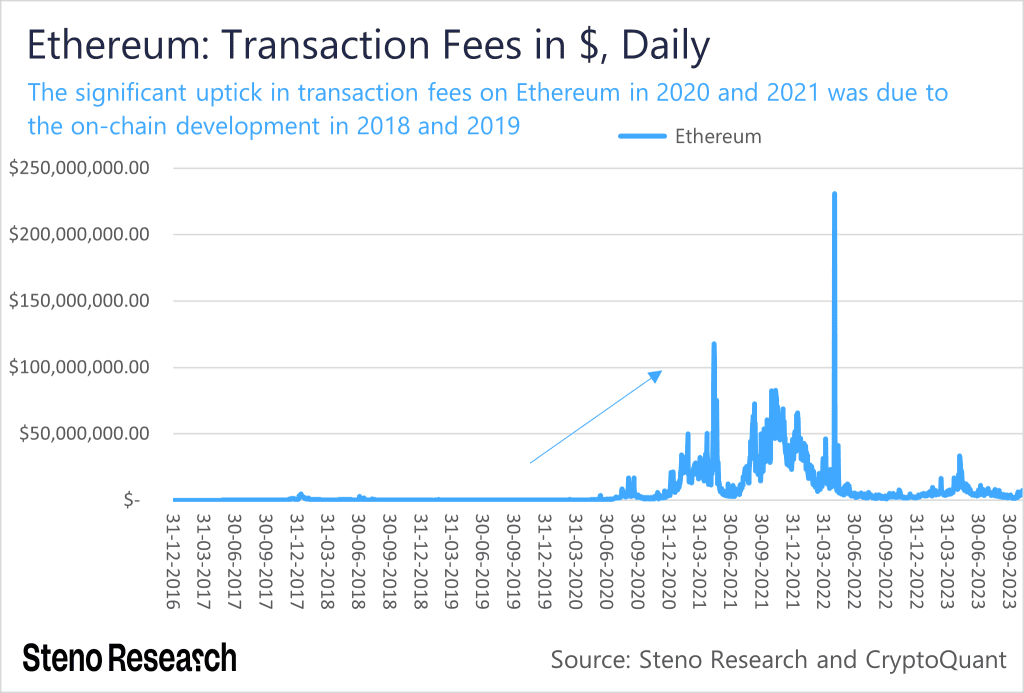

Uniswap has since turned into the backbone of decentralized finance, also known as DeFi, by having seen some 300mn trades, together with well over $1trn in trading volume. But, most importantly, Uniswap stressed that DeFi is possible, opening the floodgates to countless of decentralized protocols that launched in the following years. These protocols largely singled-handed created large demand for primarily Ethereum’s block space. This demand for block space was one of the main if not the largest driver of the even greater bull market in 2021 than in 2017. This demand for block space is, thus, not primarily attributed to on-chain development in 2020 and 2021, but rather in 2018 and 2019.

Chart 2: Ethereum Daily Transaction Fees

The problem? Few ever saw that a new crypto bull market would come after the 2017 bull market, so they did not position accordingly by keeping an eye open on the development within crypto. Yet, in a timely manner, the bull market came once again, this time again greater than the last. The point is that the industry does not sleep in bear markets. Quite the reverse, the alpha is largely to be found in bear markets by an industry that keeps innovating.

We see some of the same things in the present market as in 2018 and 2019. The most used cryptocurrencies are becoming increasingly scalable in terms of transactional output, effectively opening up for more authentic use cases. Not least, a few cryptocurrencies now have intrinsic value. This is most obvious with Ethereum following the merge last year, so it now rewards holders financially by staking rewards and a deflationary supply, alongside being environmentally sound.

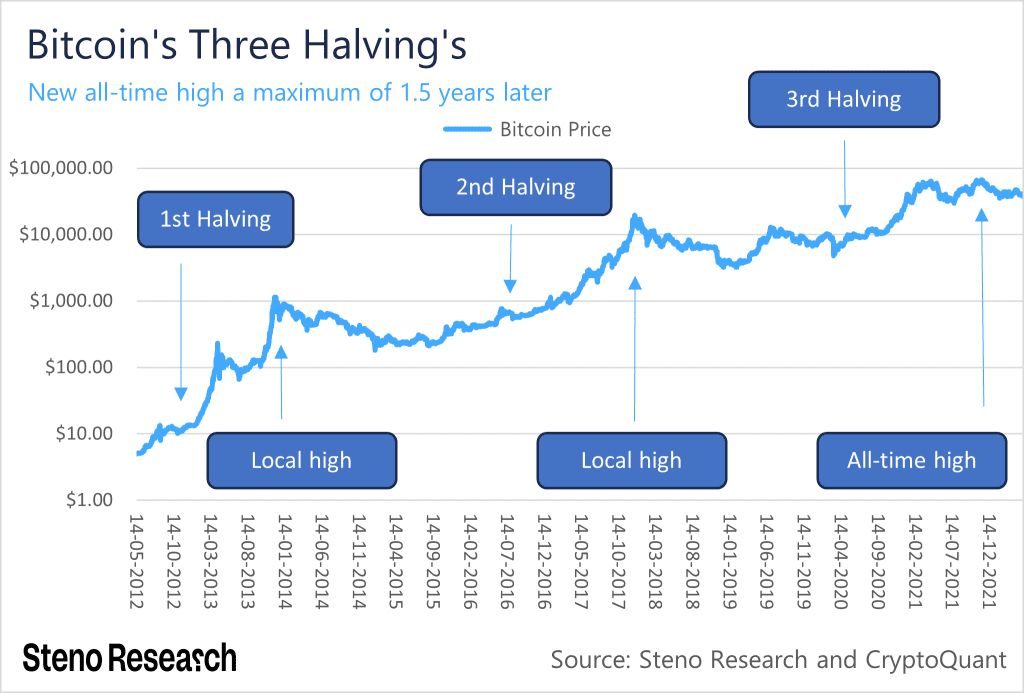

The regulatory environment is likewise clearing up with the EU’s Markets in Crypto-Assets Regulation (MiCA) bill to take full effect as of December 30, 2024. The Securities and Exchange Commission (SEC) continues its losing streak in the US on ETFs, forcing them to loosen their hold on crypto. This leads us to believe that a Bitcoin ETF is to be approved in the US within the next few months, opening the floodgates to US retail and institutional investors. Not least, Bitcoin is set to experience its fourth halving in April 2024, after which event Bitcoin has previously set an all-time high a maximum of 1.5 years later. So, there is a lot to be excited about.

Chart 3: The Bitcoin Halving History

Although Bitcoin put on a yearly high as late as today, we see this as mostly driven by already crypto advocates, rather than outside capital, so our thesis about a crypto market largely ignored by the outside holds true. We think it is a matter of time before this is no longer the case.

Back to me, as it is my second favorite thing to talk about next to crypto. I have promised my loved ones that the day the industry stops moving ahead is the day I leave for something better. This day is yet to come if it ever comes. That being said, the majority of crypto is not worth investing neither time nor money in, as the striking fact is that few cryptocurrencies are arguably to see a new all-time high again.

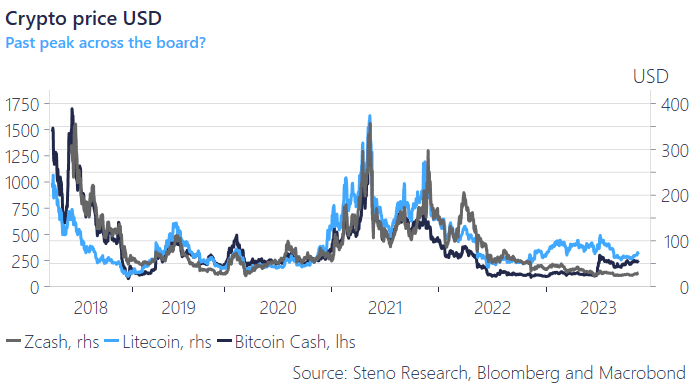

Let me give you an example. In 2017, one of the most talked about cryptocurrencies was Bitcoin Cash. It traded higher than $3,000 with a market capitalization of $55bn. In 2021, Bitcoin Cash only traded as high as $1,550 with a market capitalization of $29bn, although capital was throwing even more freely into crypto in 2021 than in 2017. Bitcoin Cash is not an unheard-of example. Take Zcash and Litecoin, all of which have significantly underperformed the market. In the meantime, some popular crypto advocates were still very supportive of these cryptocurrencies, although there was absolutely nothing to endorse on these cryptocurrencies. The signal-to-noise ratio is simply so low in crypto that it is hard to believe. I normally say that 99% of crypto is dirt, whereas the remaining 1% is on a trajectory to change the world for the better.

Chart 4: The Prices of Zcash, Litecoin, and Bitcoin Cash

The Crypto Moves series is to help separate the signal from the noise and the quality from the predominant dirt in crypto. The series is not about trading crypto short-term but rather about positioning for a potential crypto bull market long-term with at least an about 3-year time horizon. If done right and provided that a bull run comes around, as we expect, then significant returns are potentially on the table.

In the foreseeable future, we will publish a crypto portfolio, intended to serve as inspiration for how you can position yourselves in the respective crypto assets. We believe that crypto has some of the best risk-reward ratios, but it is important to state that it does not come without significant risk. It is expected that everyone knows that crypto is not a walk in the park to endless returns, but rather the riskiest asset class out there with all your capital at risk.

Next week we start the Crypto Moves series straight from the shoulder, on which topic there is now a minor teaser. As previously mentioned, there have been three Bitcoin halving’s in the past 15 years, all of which fueled subsequent bull markets. At present-day, Bitcoin miners are rewarded between $25 million to $40 million in bitcoins daily. The latter introduces a selling pressure of the entirety of the reward, as miners must finance their operations in fiat. The considerable selling pressure is undoubtedly met by buyers at a lower price than what would otherwise be an equilibrium. With the Bitcoin price being constant, this substantial selling pressure is almost halved by the next halving, estimated to occur in April 2024.

Although the halving is the worst-kept secret in the world of crypto, the market has consistently failed to accurately price these supply shocks. We do not believe that you can teach an old dog new tricks, so we are fairly confident that Bitcoin’s next halving will follow a pattern similar to the three previous ones. More on that will be discussed next week.

1 Comment

What innovations in the crypto ecosystem are you most excited about? Are there advances to building the infrastructure for financial sovereignty?