Market Watch: Forget about emergency cuts. Here is what the Fed will do next!

Good evening from Europe.

I will keep this analysis short and sweet as I know you are all trying to deal with these nasty markets and time is of the essence. We have thankfully made our way through this turbulence clearly in the money, but we are starting to see interesting counter-trends arising now.

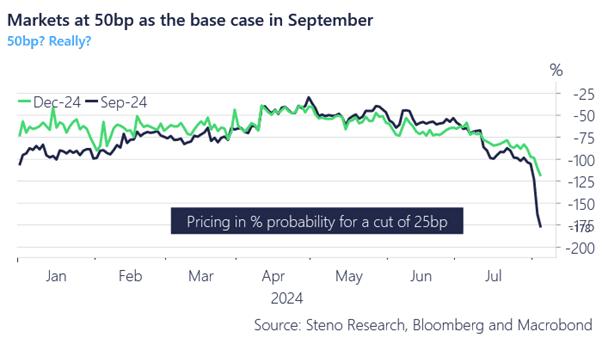

The market remains in the 50 bp camp for September, but we are trading far from the bizarre levels seen earlier today when everyone suddenly started chasing emergency cuts.

Our base case is that the Fed will settle on 25 bp in September and utilize the liquidity apparatus instead should the market force them into early action. A 50 or 75 bp emergency cut would be a disastrous move, and I think the pundits suggesting so are unaware of why.

The main takeaway is that the receiver case in the front end of USD rates is exhausted and overextended. We plan on finding smart ways to bet against it starting tomorrow. The market has completely lost its composure.

Let me elaborate.

Chart 1: Market pricing of September and December meetings

With the release of the SLOOS survey and the ISM Services data, we can conclude that meltdown fears are massively overstated. Here is how the Fed will handle the situation should the market continue to sell off.

0 Comments